Hi Fintech Futurists,

Welcome back to the Fintech Blueprint podcast. Today we share a panel recording that Lex moderated with Steven Becker, President and COO of MakerDAO, and Lucas Vogelsang, CEO and Co-Founder of Centrifuge.

The session was hosted at LendIt Fintech Digital, a vibrant community of Fintech and banking leaders. You can subscribe using the discount code “Blueprint20" to receive 20% off their $595 all-access, year-long membership. Check out more here: https://digital.lendit.com/

MakerDAO and the related foundation are the key linchpins of the decentralized economy, generating the widely used cash equivalent (i.e., stablecoin) called DAI. It is the top DeFi app by collateralized volume (i.e., value locked).

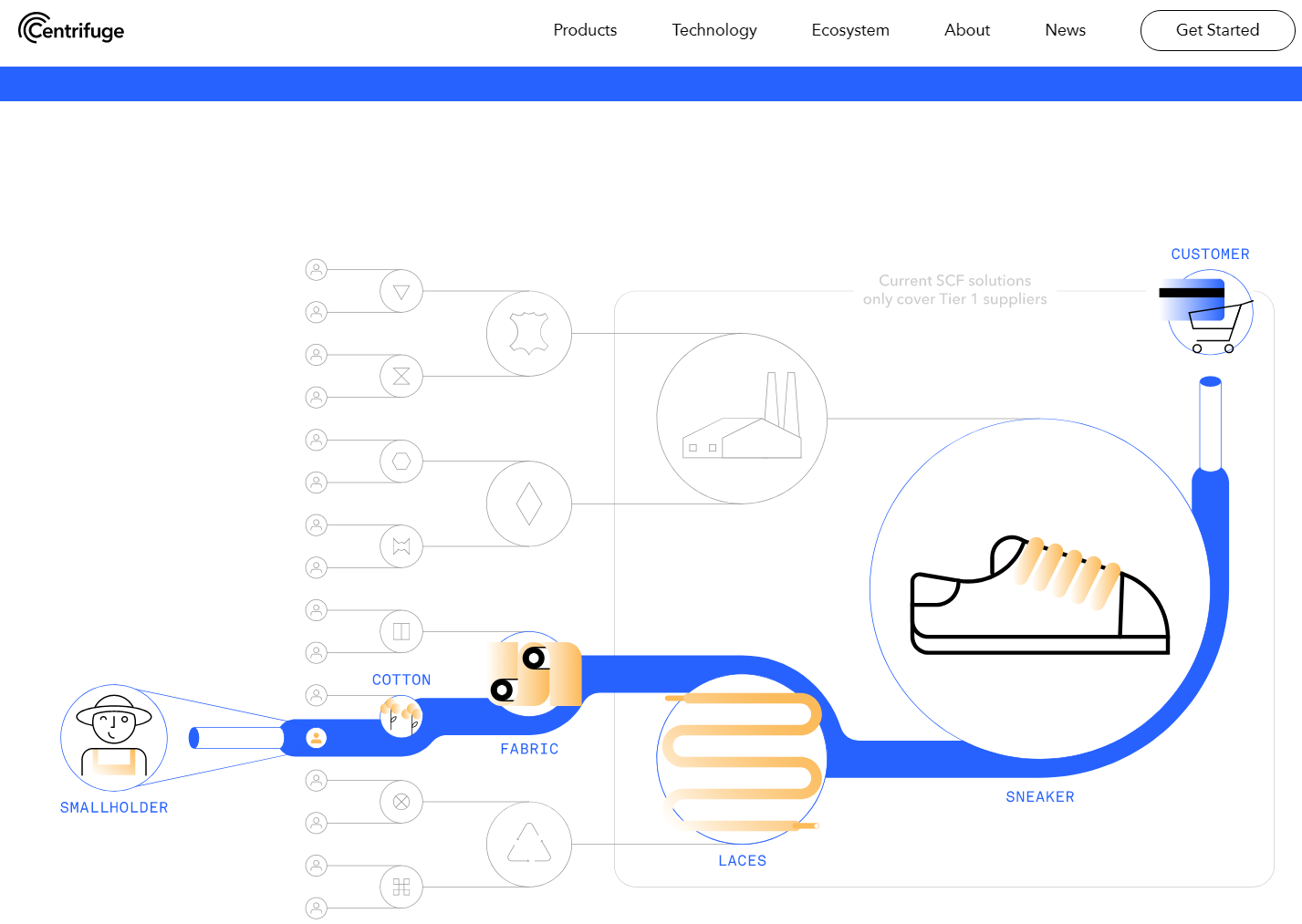

Centrifuge is a groundbreaking project working on bringing traditional assets into the DeFi economy. Its technology allows for SPVs or supply chain finance risks to be underwritten using blockchain technology. Really frontier stuff.

Here is the list of questions we brought for the panel:

Why should the intersection of traditional economy and DeFi is the starting point? What is the broader range of opportunities?

Where is the user footprint going to come from in the space? Will it be the DeFi aggregators, or the Fintechs, or someone else?

Will digital assets be convergent or separate from traditional assets?

Let’s discuss KYC and compliance issues? Is there a permanent allergy for DefFi?

Do we need so mych leverage and structured risk? Do we need this speculation to attract users? Will it hurt like the ICO collapse?

What is more important -- the asset class or the technology?

For premium subscribers, the full transcript is provided along with the recording. Hope you enjoy, and do not hesitate to reach out here!

Excerpt

Steven Becker:

The analogy I like to use with respect to decentralized finance is what's being built is effectively like the ocean, and if anybody's trying to control the ocean and regulate the ocean, you're not going to get very far. It's incredibly difficult. But what you can do is you can regulate the ports. You can regulate the shipping lanes, you can regulate the activity on this ocean.

And if you think about the blockchain space and the development of the economy in this way, then you do have an intersection between the maximalist philosophy of decentralization and the need for regulation, which ultimately regulation protects absolutely everybody on this call every single day. It is fundamentally the most important thing when it comes to operating in any space.

And you can have that intersection, if you recognize the one is a new provision of a paradigm, but how you operate on that paradigm still needs to be considered appropriately and regulated appropriately.

So when you talk about anything from the Treasury all the way through the SEC and CFTC, just in the US, when you have a look at the like regulators board, sorry, abroad, that is, you still have this capability of creating what I essentially call walled gardens, where you can operate in.

And the essence of an open market economy is decentralization. So you do have this new paradigm that fits nicely with the concept of growing a very clear open market economy space. It's just realizing that benefit through the interaction between what we understand as a regulated legal framework of operating and this new paradigm that's being created.