Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS. If you enjoy it, throw us a rating here — it helps spread the word!

In this conversation, we chat with Aaron Klein, the co-founder and CEO at Riskalyze. Aaron’s career has largely been at the intersection of finance and technology. As co-founder and CEO at Riskalyze, he led the company to twice being named one of the world’s top 10 most innovative companies in finance by Fast Company Magazine. Today, over 200 Riskalyzers serve thousands of advisors who have aligned the world's investments with millions of investors' Risk Numbers®. Aaron has served as a Sierra College Trustee, and in his spare time, he co-founded a school project for orphans and vulnerable kids in Ethiopia. Investment News has honored him as one of the industry’s top 40 Under 40 executives.

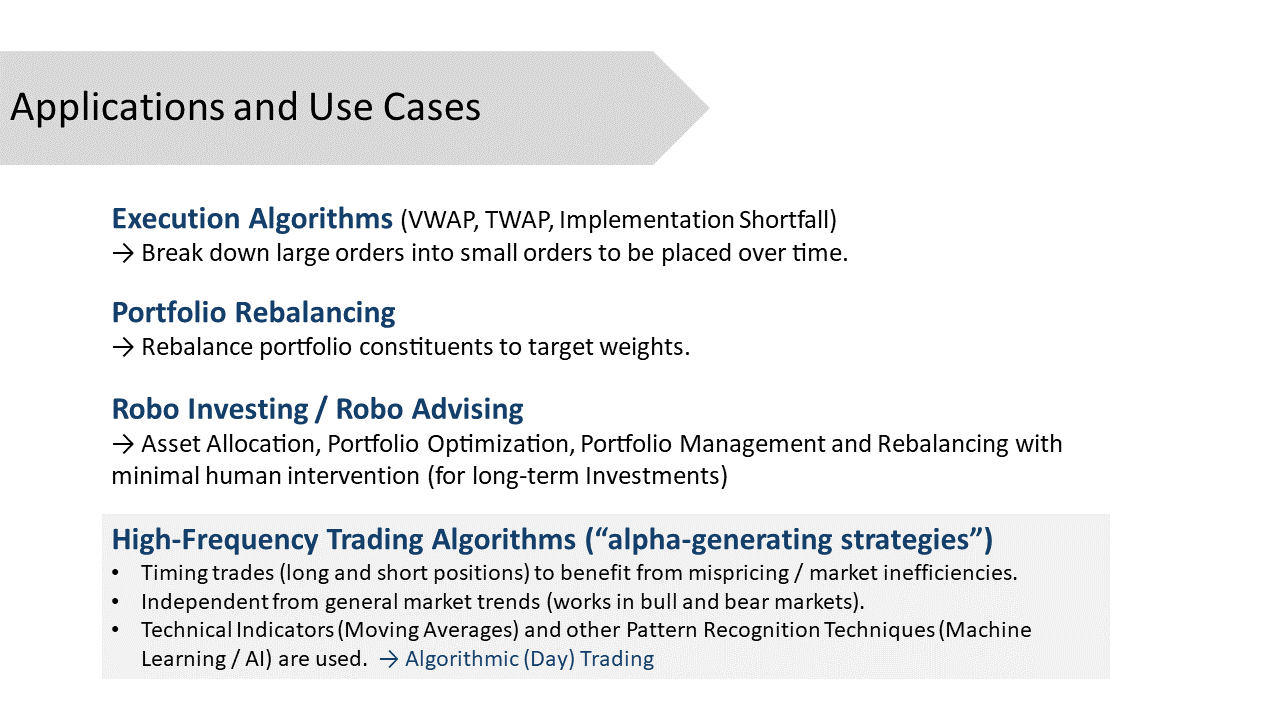

More specifically, we touch on the journey of entrepreneurship, Political campaign fintech and website development, roboadvisors vs. automated trading rebalancing, the future of wealth management and financial advice, and so so much more!!

Go deeper in Fintech and DeFi by upgrading below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Sneak Peek:

Aaron Klein:

…because when we started Riskalyze, I remember, laying it out for the team kind of. And this sounds like a relatively simple framework, but I remember just saying like, "Look, first we put a great team into place. Then we build great core technology. Then we build a great product on top of that core technology. Then we build amazing distribution. And if we accomplish those four things, none of that is easy, but if we do it, a great business is going to result Those are the inputs to a great business." And so, it was interesting because it was not obvious frankly at the beginning of Riskalyze that there would be a single risk number.

That was not a consensus opinion. In fact, it was wildly debated inside the company throughout, you might say like late 2011 and early 2012. And I think it was kind of mid 2012 that I just remember kind of putting, and I'd taken all different sides of the argument. But I kind of put my foot down and I said…

More? So much more!

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!