Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

Greatest Hits

Reminder: The Stablecoin Greatest Hits report is now available for you to check out. We aim to provide a well rounded perspective along with insights on the current stablecoin market.

The report is exclusive to Premium Subscribers, so get your FREE 7-day trial now!

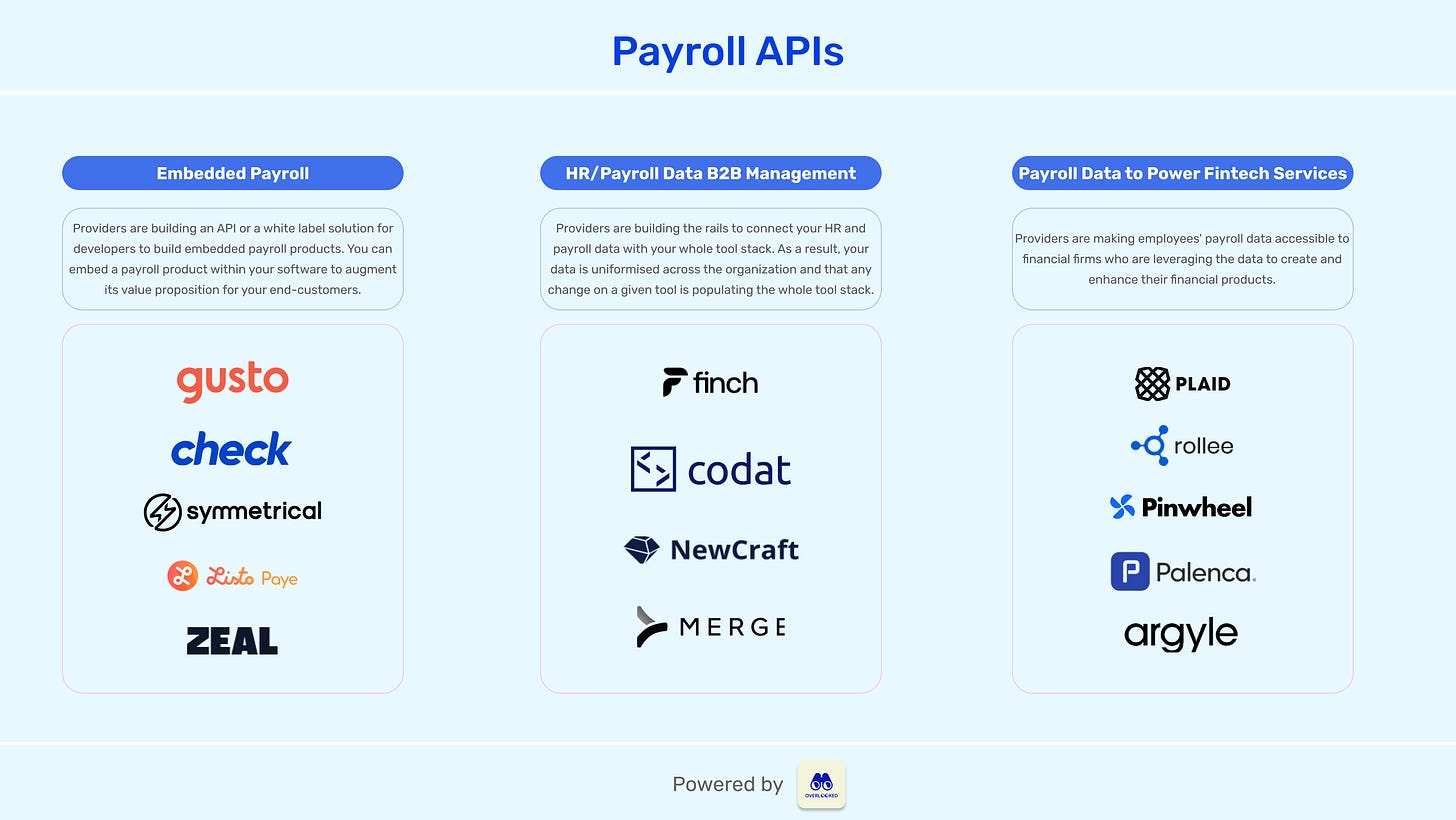

In this conversation, we chat with Kurtis Lin, the co-founder & CEO of Pinwheel, a leading payroll connectivity API. The son of two immigrant parents, Kurt saw how the lack of credit history created a greater struggle for them to access and secure financial products. This experience became a driving force for him and his co-founders to create Pinwheel. Kurt has been involved in multiple startup acquisitions, first Idean and later with Luxe.

Following Luxe’s acquisition by Volvo, he received an HSA and experienced similar challenges to those of his parents. He realized if you didn’t have money to pre-fund an account - which most Americans don’t - opening an HSA was basically impossible. Kurt and his co-founders set out to create a more automated HSA process and soon realized the key problem was actually inaccessibility to the data and controls in payroll systems. Thus Pinwheel was born with the mission to build a fairer financial system.

More specifically, we touch on the journey to building a fintech API infrastructure play, integrating inset payroll systems via APIs, the demise of payday lenders, and so so much more!

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Sneak Peek:

Kurtis Lin:

…there are a lot of other segments of society who check their platforms very regularly because they are hourly and they need to be logging time and attendance information on a daily basis. They are living much more on the margin. And so, every dollar counts, right? And so, they are constantly tracking to see, are they going to be able to make rent on time?

Are they going to be able to pay for a flat tire that came out of nowhere or an unexpected medical cost? And so, there's actually a surprisingly high number of people who do know their logins and passwords and are actually actively checking these systems on a regular basis. And that was kind of the key insight that made us really confident that building this platform that would unlock all this data in these walled gardens of payroll systems. And actually, more broadly, I would say just the income sources across the board. It's important to note that it's not just payroll systems. It's gig platforms like Uber and Lyft, it's federal portals. We cover every single federal employee in the country and as well as many state government employees as well, also what we would call future of work platforms too, so like an Etsy or eBay, et cetera.So, all of those "income sources" that we support, the thesis was if we could unlock them, connect those pipes to the banks, the lenders, the FinTechs that need that information, and then put the power of unlocking that access in the hands of consumers, it was a win-win-win, where the consumers can actually finally access better financial products on themselves. Actually, we can help people unlock lower interest rates by sharing more data or access to the direct deposit. We're helping the…

To read the full transcript, subscribe below:

Postscript.

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!