Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS. If you enjoy it, throw us a rating here — it helps spread the word!

In this conversation, we chat with Adam Hughes – the Chief Executive Officer at Amount, a technology company focused on accelerating the world’s transition to digital financial services via its digital retail banking platform, world-class digital authentication & fraud prevention tools, and ecommerce point-of-sale financing technology.

Prior to his role at Amount, Adam was President & COO at Avant, an industry-leading digital consumer lending platform. Earlier in his career, Adam was an early employee at Enova International, where he played a critical role building and scaling the company's international digital lending business. Adam holds a bachelor's degree from Northwestern University and is a member of the Founders Pledge community, a group of entrepreneurs and investors who have pledged to give a substantial part of future proceeds to charitable causes

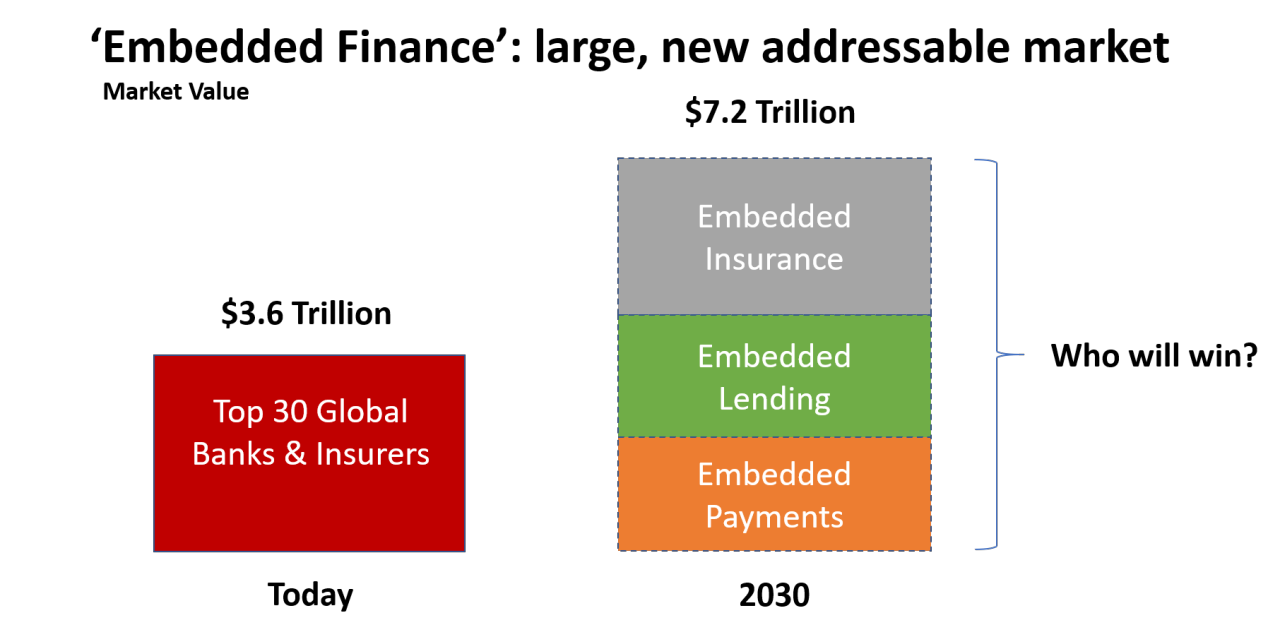

More specifically, we touch on digital lending industry Buy Now Pay Later (BNPL), as well as the trends of working with large banks and enabling their digital transformation to access some of these themes as part of embedded finance and banking-as-a-service.

Go deeper in Fintech and DeFi by upgrading below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

In Partnership With:

The Polygon x Base Camp Accelerator is taking applications until the 22nd November 2021 for the most exciting DeFi, NFT, and Gaming Program to date! Up to eight teams will join an intensive five-month program that supports founders across all areas needed to succeed, in addition to gaining access to OV’s mentor network of leading Web3 founders. For teams that are interested in the program, see OV’s website for details.

Sneak Peek:

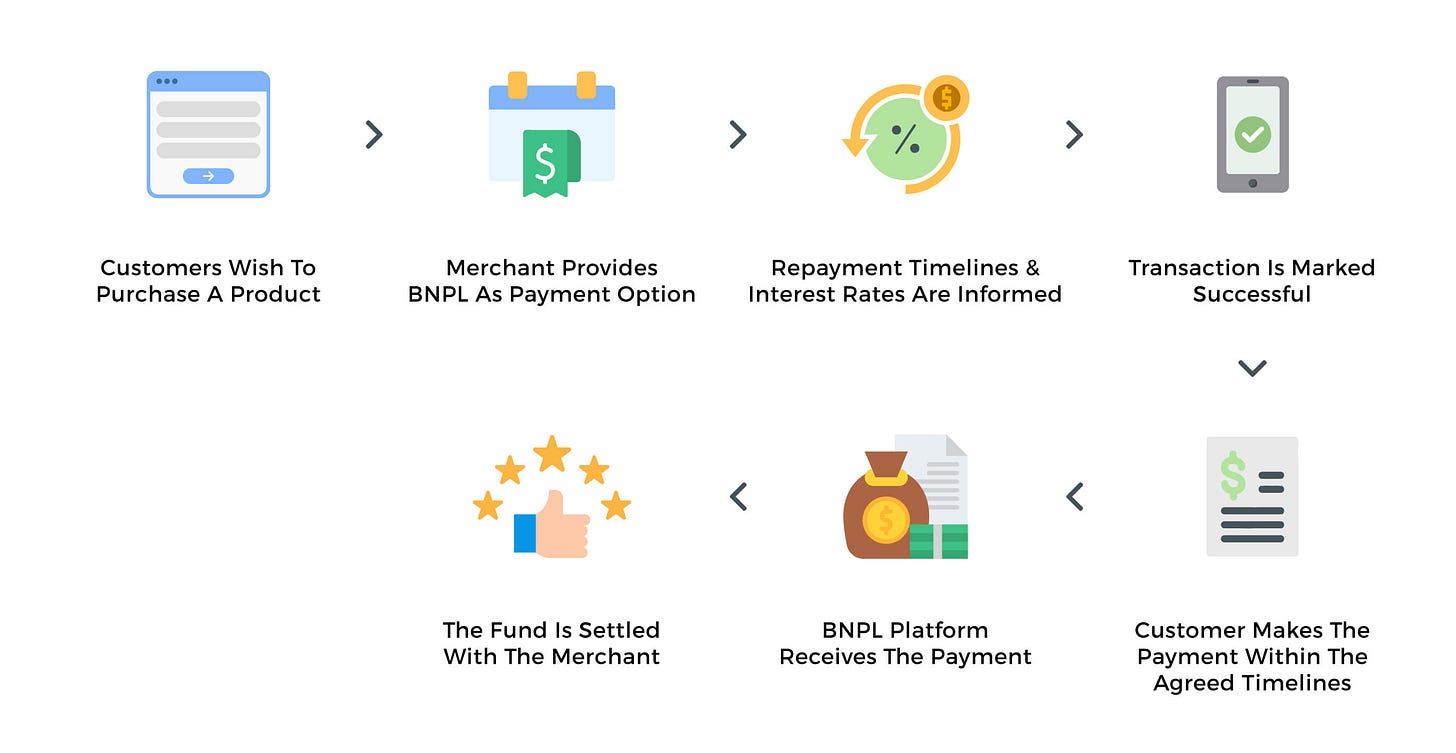

…Buy Now Pay Later today means an innovative financing product that a customer can choose to take advantage of primarily online when buying goods. So, when you're buying something online, let's take actually one of our customers. So, if you're going to Nordictrek.com and you're trying to buy a treadmill, on the checkout page, you're either going to be able to put in your credit card as most customers do all the time, or you can take advantage of TD Bank's pay overtime product, typically either a split pay product where you can pay over four equal installments or a longer installment, typically one year to two years pay over time. And that's what the "buy now pay later" products typically mean.

That product typically has the exact same installment payment due on a monthly basis. That's really why we've seen customers really adopt and like the product, because it's…

More? So much more!

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!