Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we talk all things embedded finance, platform banking, and APIs with Simon Torrance – one of the world’s leading thinkers on business model transformation, specializing in platform strategy, breakthrough innovation and digital ventures.

There’s an enormous gap between the financial needs of humanity and what the financial sector is able to deliver there. This gap is being filled by tech-savvy solutions and embedded finance plays which are putting into question the role of a bank in this new ecosystem.

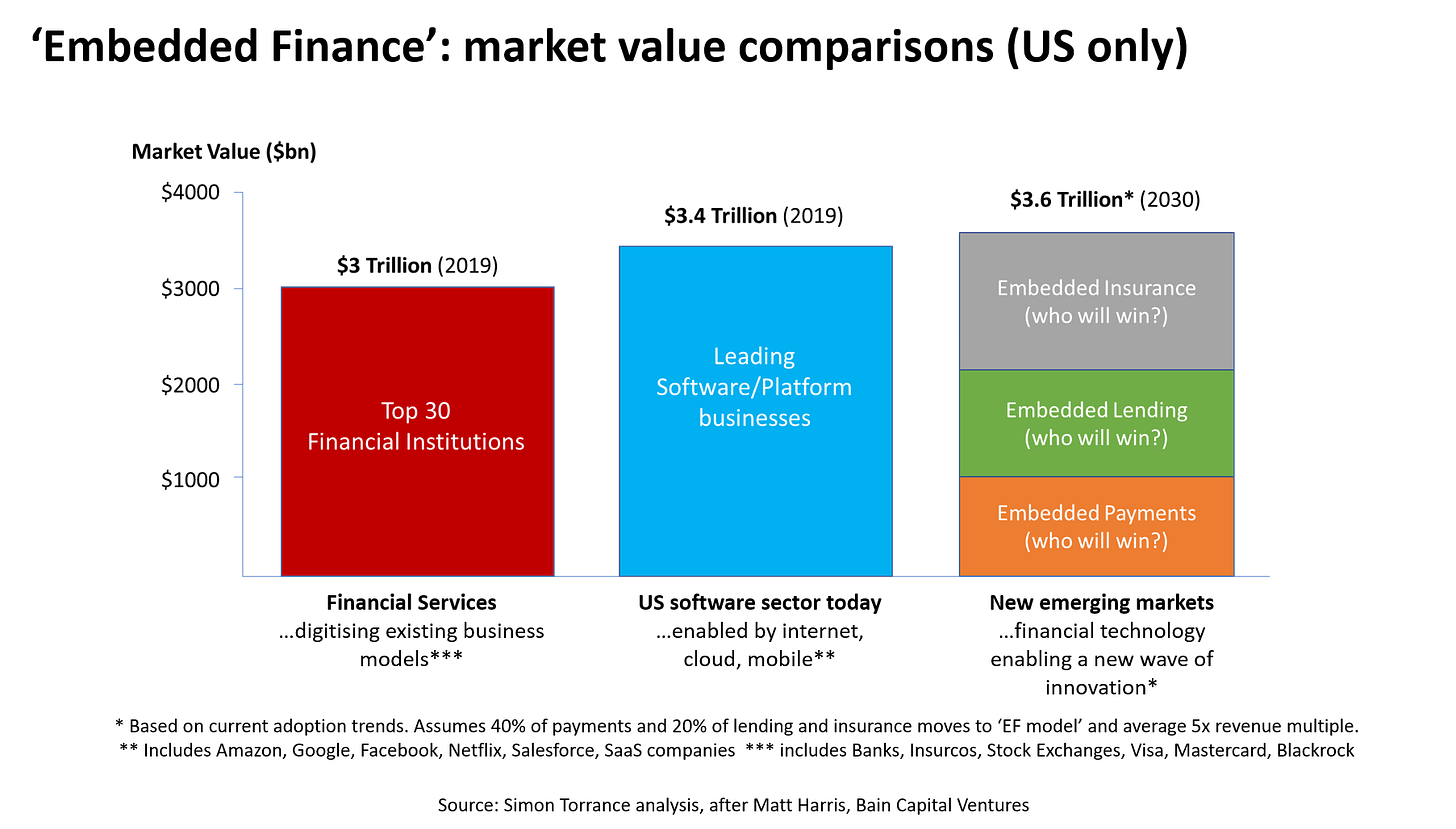

Simon’s recent analysis suggests that Embedded Finance is merely a decade out from offering a new, very large addressable market opportunity worth over $7 trillion, which is twice the combined value of the world’s top 30 banks today.

For premium subscribers, a full transcript is provided along with the recording.

Hope you enjoy, and do not hesitate to reach out here!

Excerpt

Simon Torrance:

So let's take an example here. Standard Chartered is quite a good example, based out of Singapore, but a big bank in Southeast Asia and Africa. And this example is quite good because their core business, like all banks, is suffering. And so they created a separate...

Lex Sokolin:

Sorry to interrupt. But I just want to highlight that their core business, the core business of Standard Chartered, is they're in the business of suffering. To be suffering, is their core operating activity.

Simon Torrance:

Yes, exactly. Exactly. Quite cleverly, very cleverly, what they've said is that we've got the core business, which is all about suffering, as you say, and we need to optimize that, but we've got to do something to get out of this rut we're in. So they created a separate unit called SC Ventures to try and invent the future and fast track that future and to do it away from all the old metrics and culture and everything in the core business, because you cannot do breakthrough innovation within the core.

And that business is proving pretty dynamic now. It's spinning off a lot of ventures, working with entrepreneurs to do so, and one of the ventures is something called Nexus, which is a bank-as-a-service proposition. And this is publicly available information. They've essentially created their own FinTech business in this space in embedded finance and put a lot of investment into it.

For the annotated transcript and additional premium analysis, subscribe here: