Hi Fintech Architects,

In this episode, Lex interviews Andrew Jamison - CEO and Co-founder of Extend - a financial infrastructure platform that helps banks innovate financial product development with capabilities while working with their existing systems, starting with virtual cards. Andrew shares his journey into fintech, detailing his experiences at American Express and the evolution of virtual cards. He discusses the challenges and opportunities in the virtual card space, the founding of Extend, and its innovative approach to simplifying spend management. The episode highlights Extend's rapid growth, unique market position, and the future of financial management, emphasizing real-time transactions and integrated solutions for businesses.

Notable discussion points:

Virtual Cards = Smarter Spend Management

Virtual credit cards revolutionize payments by enabling real-time reconciliation, reducing fraud, and improving financial control—especially for SaaS, digital ads, and legal expenses.Extend’s Edge: Partnering with Banks, Not Disrupting Them

Unlike Brex and Ramp, Extend powers virtual cards on existing bank-issued cards, making adoption seamless for businesses while strengthening bank relationships.B2B Payments Go Embedded

The future of finance is embedding payments directly into platforms like SAP Concur - letting CFOs manage expenses within the tools they already use.From Enterprise-Only to Instant Access

Virtual cards once took months to implement. Extend’s API-first approach makes them deployable in minutes, bridging the gap between legacy banking and modern finance.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Fintech Meetup

It’s time to get ready for a huge 2025: join thousands Fintechs and FIs for the ecosystem event of the year on March 10-13 at the Venetian, Las Vegas.

You’ll be part of the industry's largest, most productive, and highest-rated meetings program. Don’t miss your chance to connect in over 60,000 meetings with banks, credit unions, fintechs, investors, and professional services firms. The event will feature a carefully-curated agenda packed with insights into the future of fintech. You’ll hear from industry visionaries like Kathleen Peters, Chief Innovation Officer at Experian, Eric Sager, COO at Plaid, and Kate Walton, MD & CCO at Merchant Payments, JPMorgan Chase & Co.

Whether you’re a start-up pitching for investment, an exhibitor unveiling cutting-edge AI solutions, or a financial institution developing the next-gen digital platform, Fintech Meetup 2025 is THE place to be this Q1.

Background

Prior to Extend, Andrew was the head of B2B Corporate Payments Products at American Express with a mandate to drive digital payment innovation and adoption.

Over the course of six years, he doubled B2B payment volumes by launching and scaling new capabilities and platforms.

Prior to American Express, Andrew spent eight years managing global SAP deployments for large multinational corporations. He earned an MBA from INSEAD.

👑Related coverage👑

Topics: Extend, American Express, AMEX, SAP, fintech, credit cards, spend management, virtual cards, B2B, API, banking infrastructure, embedded payments

Timestamps

1’10: From Green Screens to the Cloud: How Early Tech Shaped Andrew Jamison’s Approach to Business and Automation

5’12: Scaling Amex: Expanding Beyond Travel to B2B Payments and Virtual Cards

10’27: Virtual Cards in Travel: Solving Payments but Struggling with Scale

15’19: Virtual Cards and On-Demand Growth: How APIs Unlocked a New Payments Model

19’17: From Amex to Extend: Reinventing Virtual Cards for Everyday Business

26’00: Scaling Smart Payments: How Extend is Reshaping B2B Credit Cards

29’33: Rethinking Spend Management: How Extend Partners with Banks Instead of Replacing Them

31’47: Built for CFOs: How Extend Streamlines Payments and Expense Management

35’08: The Future of Finance: How Embedded Payments and APIs Are Reshaping the CFO’s Role

40’34: The channels used to connect with Andrew & learn more about Extend

Illustrated Transcript

Lex Sokolin: Hi, everybody, and welcome to today's conversation. I'm excited to have with us Andrew Jamison, who is the CEO and Co-founder of Extend. Extend is a really interesting company focused on credit cards and spend management and the larger platforms that are built around that. Andrew, welcome to the conversation.

Andrew Jamison: Lex. Thanks for having me on the show. Delighted to be here.

Lex Sokolin: My pleasure. So, let's start at the beginning. How did you get interested in this space and what were some of your foundational experiences?

Andrew Jamison: I guess I sort of got into space a little bit by accident. I started my career after declining a job with one of the sort of top three strategy consultants, which I, in truth, regretted for at least four years.

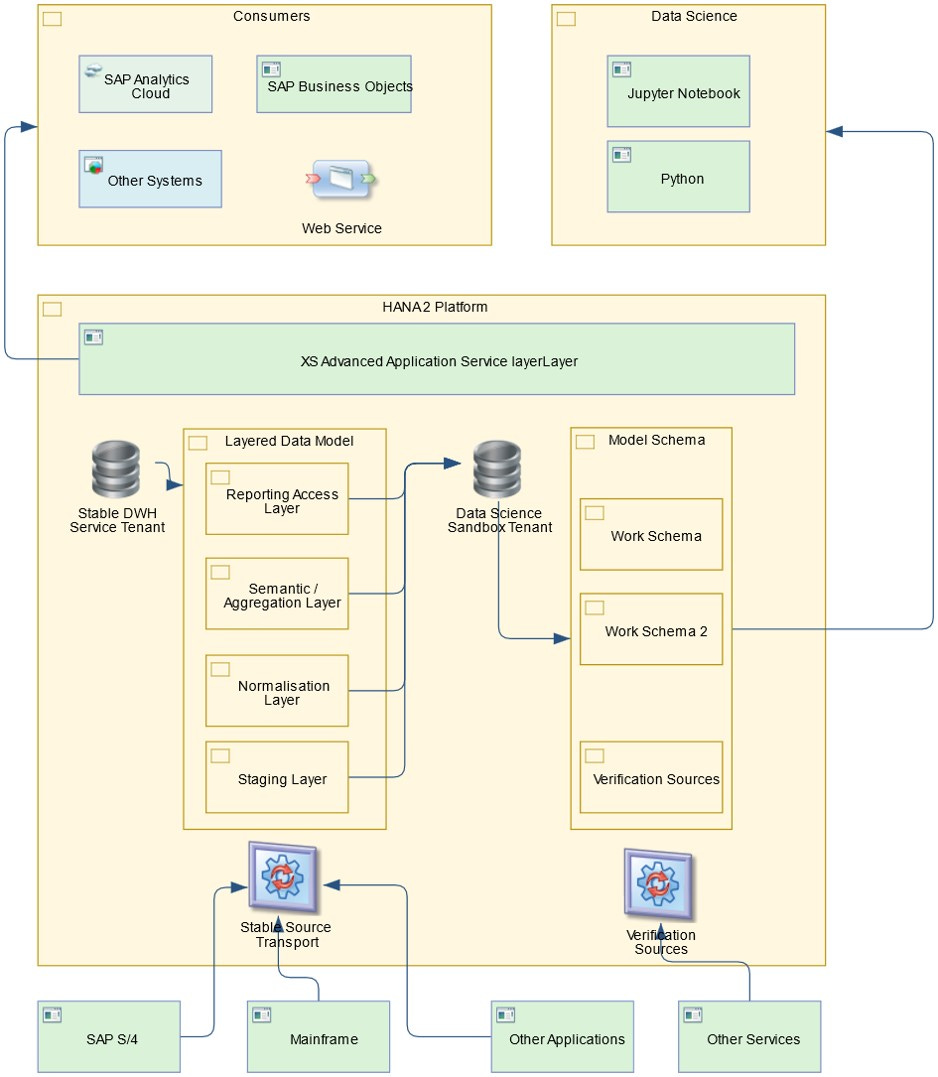

But I went into the world of SAP. It was a pretty hot market back in the mid 90s. It was really just starting to explode and really sort of for me, the idea was to ground myself and sort of core skills, and that meant sort of understanding technology, getting more focused on the finance functions, accounting functions, realizing that my father as an entrepreneur was like, you need to cut and get some real skills. Like, you know, what are you going to do in a strategy consulting role? And I took his advice and sort of went down this path. Long story short, I spent ten years there and really sort of got to see what happens when you move from a mainframe environment to a three-tier architecture right split between the database the logic and then the user experience. And that sort of started to influence a little bit my thinking around, you know, where technology was going at the time. But then I left, I went to INSEAD back in 2002, 2003 and ended up joining American Express, actually in London.

Lex Sokolin: Before we get to American Express, the distinction that you painted between a mainframe environment and one that has more segmented layers, can you expand on that a little bit, like what was a mainframe environment in that context?

Andrew Jamison: The best way to think about it was it's a green screen, right? You input an order and you get shipped to a screen to make some parameterization. There's no there's no real workflow really associated with. It's almost like you're punching in keys and codes to set things. And then the programs are running in the background. But it's sort of one unified, you know, monolith that is actually really hard to customize, and certainly one that that sort of makes it nigh on impossible to be in the cloud. And that to me was the key thing was sort of seeing just, you know, it felt like you were in the 60s, frankly, even back in the 90s, it sort of felt like you were going backwards rather than forwards. You know, we're sitting in front of laptops for the first time, and there was a lot of excitement around that.

And yet here we were going back to green screens. And to me there was a there was a disconnect. It was a highly, highly technical job. That was the other thing that struck me. It was very hard to get people with a business mind to really focus on the issue at hand, because it was so deeply technical. I think then you then change that to sort of start splitting things out right into the database repository of information, the logic that sort of like is the engine room, the brain behind the system, and then, you know, going there and say, okay, but over the top of that you can layer a different user variances for me was really interesting because you started having more of a human aspect to it. You started to be able to engage with finance departments, to sort of really talk about the end-to-end flow of transactions and the business flows. And so, all of a sudden, I felt you were much more focused on automation.

And because it was easier to translate between technology and business, and you could actually engage the businesspeople into those conversations because they had something to react to, right? In that whole process flow. And that that was the interesting part for me. And that's the place I spent most of my time, was hovering between the technology piece and the businesspeople and sort of creating the connective tissue. Right. And so, as a result of that, I got pretty good at understanding what really had to be happen in the in the orchestration layer or that middleware logic tier. And as it turns out, right, that in a way became the foundational pillar of how I started thinking about the application of technology and business.

Lex Sokolin: It's almost like getting out of the engine room to a place where the users and the businesspeople could understand what's going on.

Andrew Jamison: That's right. Suddenly you felt you were a little bit more at the cockpit. And that to me was, was the interesting part.

Lex Sokolin: After business school, you are at American Express. What does American Express look like at the time?

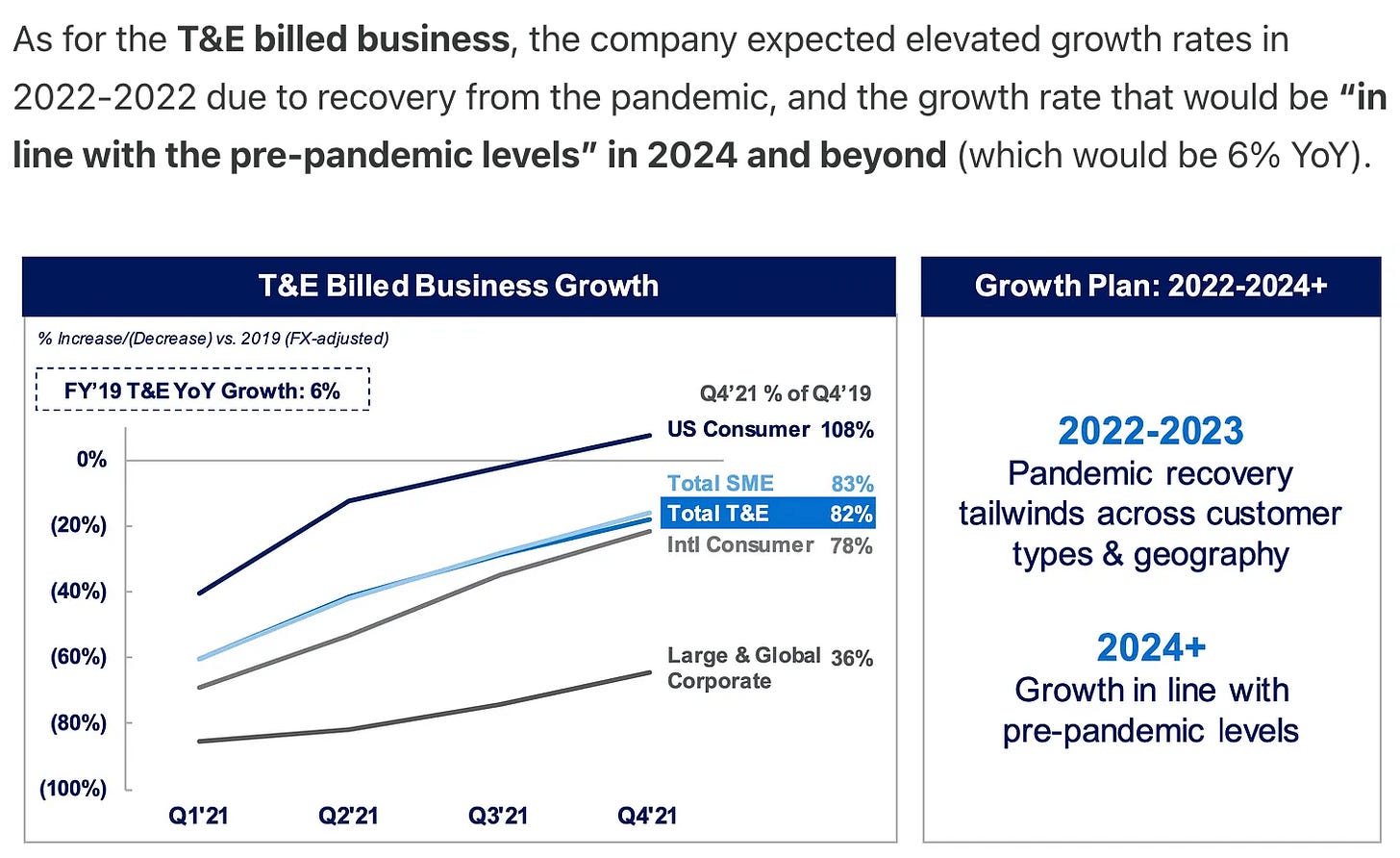

Andrew Jamison: So, what I joined them in in London, they really were suggested the beginning of straddling into indirect spend. And so, what I mean by that is if you look at the history of the company and you think of a history of credit cards, it was really a consumer product that replaced traveller’s checks in many ways, and it had grown over decades. And then American Express had forged itself into a leader position across most of the markets around the world. Actually, as the travel and expense card that businesspeople like that travel globally wanted to have in their wallet. And that's largely because Amex was unique in that it dealt directly with the merchants, it dealt directly with the corporate customers, and so had really clean data, and it meant the data could be consistent from market to market, which again, when you then think of where that data has to flow, made it easier for businesses to create a uniform process for their different businesses around the world. Right. IT process could be the same in one market relative to another.

And again, that helped us standardize things in a world where we're all heading towards this ERP landscape of one platform to run an entire business across the world. But the interesting part there was they had realized that in order for them to continue to grow, they had to go beyond the T&E. And so, start to think a little bit more about how they could impact other purchases, right, in that indirect space. And what I mean, indirect, I mean, not sort of bills of materials or goods that go into manufacturing products, but all the other things. like how you manage the office, right, how you think about, you know, buying potentially other services as well. So that's the world where I entered. And my unfair advantage there was actually because I had learned process through SAP of how things happened, really from a purchase order all the way through to an invoice and then a payment. The unfair advantage I had was I was a step ahead to some degree in terms of understanding what the customers needed.

And so that's the journey I embarked on, was really to help them grow that B2B business from really what was a really, really small chunk of their business to, to something way, way more significant. In fact, we tripled the size of that business over really the last five years of my time at Amex.

Lex Sokolin: What is it that the customers needed that you knew?

Andrew Jamison: So, the really important thing was what customer wanted was data and reconciliation. So, the idea that you would keep putting all sorts of transactions onto one statement. One card left you with a different problem at month N, right. It helped with the payment and the settlement, but then you have to figure out who on earth had gone and spent on this particular item, right, with this particular supplier, and therefore, how would you account for it? And so, the journey then, is what took me over to the US in 2006, having realized it's called American Express, not British Express, was really the saying, let's go to the mothership.

Amex was in the throes of buying an electronic invoicing company, the simple concept being if they own the invoice, they had the first right to finance it, which in itself was a really clever idea. The challenges we then went bumping into the financial crisis and all businesses that are pulled back from anything that wasn't core, but out of the acquisition that they'd made of this business, they realized they didn't have to necessarily deal with all the workflow of the purchase orders and the goods receipts and the invoices. They could just focus on the payment piece. And could they actually just take a payment instruction right from these different platforms and system and help to go and settle those invoices on credit card rails so that the companies would benefit from working capital so that the companies would benefit from financial incentives or rewards at scale. And that's really the business that we got into. And then and then we did another acquisition of GE when we got really and this brings us right the way round eventually to Extend, we acquired a virtual card platform from GE.

And GE was one of the first players across the world to get involved in virtual cards. And just to pull that layer back, what is a virtual card? A virtual card is a card like any other card, except its whole life is digital. Never is it printed to plastic. The idea being that if I could create a unique card number and tie it to a very specific purchase. Then the minute that that card got charged, I could just allocate that payment to that particular invoice, thereby closing the loop and helping that reconciliation happen instantly. And so, it was actually quite a transformational technology in terms of helping businesses and specifically finance departments, take paper invoices and paper payments out of the back office.

Lex Sokolin: Interesting. What was the competition like around virtual cards when this acquisition happened and when you were working on it? Or maybe another way to put it as what kind of early customers did you see adopting the technology? If you have any specific examples?

Andrew Jamison: No. Look, it's a great it's actually a great it's a great question because it's right at the root of of both the benefits and the challenges.

So the technology, by virtue of it sort of being designed by GE. And you can imagine GE, you know, a massive conglomerate company. Right. We were going through a period of time with if there was no purchase order, there would be no payment because everyone thought that, you know, you had to control everything. And so that's why they'd come up with this technology, right? You create a purchase order, it would be approved, and then a virtual card would be appended to that purchase order they sent over to the supplier. Pretty, pretty neat, pretty clean and pretty efficient. And then at the same time, there's another company called Orbis in Ireland that got involved in this, in this space too. So, what were the use cases? A lot of the use cases centred around when there was an intermediary in a transaction. So let me give you an example. So, if you were an online booking platform right. And for instance, as a consumer, you would come in to book a hotel in San Francisco.

The idea was that they would charge your personal credit card at the time of booking. But what happened after that was, they would take that booking and essentially go and create a virtual card for the amount of your stay and actually append that card number to the booking that went to the hotel property. And so, when you turned up the hotel property, they would always say, I need a credit card for incidentals because they knew they were locked and loaded as it related to your stay. But they still needed a card for incidentals in the event you use the minibar, or you paid for meals and different things through your room. So that was a lot of the technology. And the benefit it had was if you were the hotel property, you were no longer having to send invoices to the travel agency. You were just charging the card like any other guest. And essentially the process was completed there and then. And if you were the travel agency, you weren't having to have hundreds of people in the back office managing essentially the bookings and then making sure the invoice is tied back to the bookings.

And all the time it took to reconcile before you then made the payment to the property. Right. So, properties same process got paid instantly as far as the online travel agency. It was a situation where they effectively got to manage things in real time and reconcile essentially the bookings directly to people's stays. So, as you can understand, it was quite a big project to go and install this. It was a technology project. There were teams that had to be assigned to make these things work, and as a result of that, banks could only really deploy this across the enterprise segment, their biggest customers. Because if you've got limited resources, the idea is that you're going to go and chase the biggest opportunities. And so that in itself was really the biggest challenge. It was a brilliant tool. It's just when it takes anywhere from 4 to 8 to 10 to 12 months to implement, it has very little reach. And that was really the challenge. The platform grew really well relative to the number of customers and the volume that was generated through it. But again, the whole point was it wasn't easily accessible.

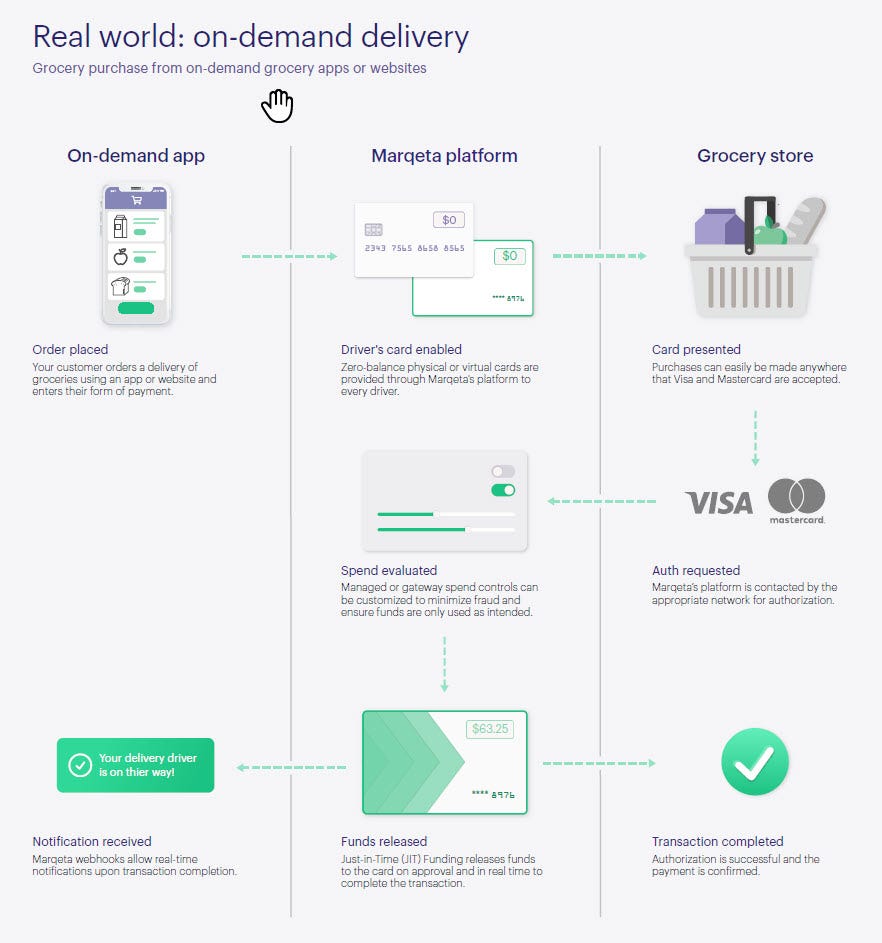

Lex Sokolin: I, keep thinking about an example that I think relates to Marqeta, and its early days. Maybe it's topical, I don't know, but I remember that the company struggled quite a bit to get any real traction for virtual cards for, you know, years wandering around in the desert and never quite getting any sort of product market fit. And then all of a sudden you had the emergence of on demand delivery services. So, you know, in the case it would be Deliveroo in the US, it would be Uber Eats. And because the drivers, the contractors are independent of the actual platform, you need sort of to have this third party relationship where you don't really trust the contractor, so you don't really want to advance them any credit line, but they need to be able to go to a restaurant and pick something up, or to have budget specifically for that item, and the virtual card became the exact right instrument for that, where you would create a specific card for a specific transaction with a limit that was exactly the amount of the order.

And you'd limit your liability by giving, you know, this third-party contractor access to to spending. And of course, once those platforms started to grow, you would need millions, if not billions of these cards for each transaction. Were there catalysts that you saw like that for the industry, or I guess once you got to the same problem with or a similar problem with Extend, what are sort of the fastest growing customer categories.

Andrew Jamison: So, so like the example you give is a is another great example. Right. It solved the issue of access right. For a lot of effectively Freelancers, contractors, temporary workers. It went a little bit even beyond that. What was really smart about that particular solution, and this is where neo-processors have actually made a play, is the idea that they changed how transactions were authorized. They weren't they were specifically in the authorization flow. And what they did was they enabled essentially a company, Deliveroo, right, or Uber Eats, to effectively be able to receive that authorization request and actually be able to respond to it, not based on patterns of spend, which is how credit cards have operated for forever.

Right? It's almost like, you know, this is in pattern. This is out of pattern. That's where we get declined sometimes when we go overseas or different sort of situations. But in the case, here is what they did is they enabled right, the delivery company to say this account number is in the hands of this individual. They are meant to be at this restaurant. And can I cross-reference write the name of the restaurant with where the authorization came from? Right. And can I cross-reference at this card should be active because Lex is actually on duty and is in this zip code. So that was really the gem behind it was getting into the auth stream and being able to do instant decisioning in a very different way than had been done in the past. Right. That to me is still the magic sauce that they have. And others who are in this neo processor world have. And that's all well and good, but I think the challenge that we're seeing across those platforms and industries is there's only so many corporates, right, that want to actually issue their own cards and manage essentially their cash through these.

In many cases, these are all debit cards. And so, so cash is moving back and forth across the ecosystem. But that's really the big question mark there for me what I saw that I really liked in that platform that did influence me when I, when I finally got around to creating Extend in 2017, was the idea that you could get right that simple, easy access right to these virtual cards that could be shipped direct to someone's phone. And the idea also that corporations could go and build applications over the top of these modern, this modern suite of APIs. Right. They'd removed the friction that existed in some of these cases where these sorts of monolithic APIs that were baked into mainframes. And so, it made it almost impossible for the banks and the issuers to sort of give a carved-out access right to one individual and the next individual. And that in itself, trying to give people access was a whole project. And that's where, you know, these neo platforms have come on and said like, no, no, no, no, these APIs are going to allow people write easy access.

And so even if you're a small middle market customer, you can bump up against these APIs and you can be generating virtual cards in the matter literally of minutes if you're a savvy programmer. And that's those two things to me really made me think about, okay, there are different ways that we can actually solve for this access question I had and therefore solve for the price point at which you could actually go and deliver this capability.

Lex Sokolin: So, let's transition into the founding of Extend and the original way you try to approach the market, because you were coming from, you know, American Express with lots of resourcing and kind of slower development cycles and the ability to do big acquisitions. And here you are saying, okay, I'm going to be a founder and fight my way up the food chain. What was that like? And sort of what was that initial entry point.

Andrew Jamison: Yeah. So, I think my journey wasn't quite that cut and dry actually, I left Amex not because I was starting Extend. I actually left Amex for personal reasons related to my mother's health.

And so took a sabbatical and sat on the sidelines. And I'd say that journey, the journey of not having to think about the next deliverable, that I had to be over the top of, right, the next milestones the teams had to work against. And just thinking a little bit creatively without the sort of pressure of the daily work routine, right, is something that sort of allowed me to sort of go back and rethink how I thought we could deliver services. One of my bosses at Amex at the time had told me that all of the project I worked on made her hair hurt, and I was like, wow, that's that's a real compliment to to the work that I deliver. But what she was really saying was everything I'd worked on to date had really been enterprise as a solution. And if you think of the core of Amex, it's a consumer company that really thinks about the value, the benefit, the service and its easy to wrap your head around what it is that is delivered.

And yet the payment solutions I've been working on. Right. Which is this straight through processing or virtual credit cards was more complicated, right? It was embedded in B2B and processes of purchases and systems. And it was highly complex. And so, I took a little bit of that to think about, okay, how do I solve for this complexity piece. And that's really where upon looking at a couple of other job offers, I sort of decided, actually, you know what? I'm going to step out and try and build something. As I mentioned, my father was an entrepreneur. And so, I thought, okay, let's give this a whirl and see how it plays out. And the premise for me was really quite simple. I thought every cardholder actually had the tool that they needed in their hands already, and that's basically they had a card, and they rarely used a full credit limit on that card. And then all of us had access to a smartphone and to the web.

And so, the idea was instead of making virtual cards a product, an end of itself, I was like, can this not become a feature of a card that is already in the hands of a customer, in the same way as you get insurance with your card when you go and rent a car? And so that was the underlying thing, was, could I develop a platform that would take into account the idiosyncrasies of, you know, what underlying technology banks were using, but be able to then take that and overlay it onto a standard card that's already out in the wild. So that was the underlying concept that I went into as I thought about building Extend and that sort of 2017 timeframe.

Lex Sokolin: Let's go one level deeper. Like what does that mean?

Andrew Jamison: Yeah. So again let's get back to use cases right a little bit. My theory here was one that, in the same way as a large corporation uses a credit card, so does a consumer. And so, it had nothing to do for me with the size of company.

It had more to do with the types of purchases that that people wanted to do. And whilst we focus on commercial, I absolutely saw the use case, by the way, for consumer. And it was rare that I go into a meeting where people said, well, this would be great for my nanny, this would be amazing for my children in college, right? The idea that you would have a credit card and you'd be able to shard a piece off it and, you know, ship it over digitally to someone in your own, a circle, right, simply by having their email address and, and the idea that they could receive it instantly, load it on their phone and go and make an instant purchase online or in a store. Right. Even today, I look at it when like, my son is13 and goes to the movies. I mean, I send him cash through Zelle. It would be so much more efficient if I could actually show it off a piece of my credit card, and I'd earn the reward.

I'd see what he's spending. Everything would happen in real time, and I have total control. Now, we're not there yet. But the same problems are real in the business context. More and more of the purchases that we make today in business and Covid has a part to play in all of this, are really SaaS fees and SaaS subscriptions. And so, we have a lot of businesses who go and create virtual cards to help manage how they purchase slack, how they pay for AWS. Right? The idea being that they set a finite amount against it, and if they get an invoice or request of payment against that card that exceeds that amount, then it instantly triggers a decline that triggers a discussion that allows you to actually go and solve for the problem before you have to then go and demand a credit. But it goes much further than that, right? We have in our business also a lot of companies that are all sizes in the digital advertising space. They are managing campaigns for tens of clients, sometimes hundreds of customers.

And those campaigns are run across three core platforms. And the idea being that they need to manage every one of those campaigns, and they need to manage them to a specific dollar amount. And so, they need more control. And so, they're able to put a virtual card against different campaigns on different sites and be able to see exactly the campaigns as they perform and be able to shift credit from one campaign to the next, right, to essentially manage how that process goes. And the same applies to other companies that have the actors’ intermediaries. Think of law firms who manage many cases against different companies or different individuals. Same thing. They want a virtual card to represent a customer or case. And the minute that essentially, they go and make a payment, they can rebuild that customer instantly. Right. They're no longer waiting for an invoice and trying to figure out who that particular case payment belonged to. They can actually do that reconciliation in a heartbeat.

Lex Sokolin: Each card can be used as a way to separate out streams of, you know, different commercial activity. You started with retail examples and kind of pointing to the importance of retail as you were taking a break from American Express in the business today. What is your focus? Is it retail or is it B2B? And then in describing the product, maybe you can help us understand the scale of the company. How much transaction volume are you seeing? How many clients do you have and what sort of footprint you've gotten to?

Andrew Jamison: Yeah, absolutely. So, if you think of the footprint that we have today, right, we have about +7500 customers using our platform regularly. Right. We are helping process a run in a run rate of about $7 billion, and that's pretty much doubled from what we were doing in January. So, growing very, very fast in a world where we are just seeing more and more businesses wanting to use these kind of applications to help them run their businesses more efficiently. I think we're very different from other players in this space. Right. You think of as Brex ramp spend as you can.

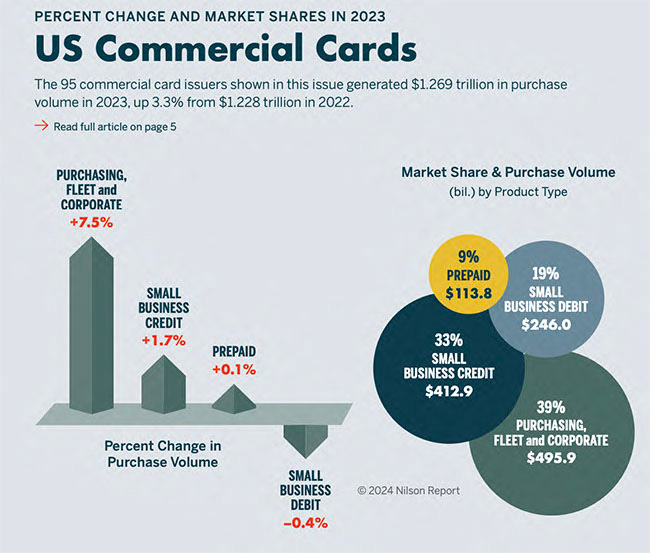

Keep going, right? There's a there's a whole host of these different players, and all of them have figured out that there was a hole in that sort of middle market segment, right, for these kinds of applications. And so, they've set about essentially going to build their own brands to go after. It was a little bit different about Extenders. We chose to go and partner with Main Street Banks. Right. My belief was actually people are pretty loyal to their banks because their banks do more than just the card part of the business, and not that many people want to go and change providers. So, we're different in that we don't underwrite, we don't issue, rather, we sit over the top of underwriting and issuing capabilities of the Main Street banks. And that's because my belief is whilst those companies have seen, you know, great early adoption, the majority of adopters are only just getting in the game. Right. And so, if you think in the US alone, the commercial credit card space, about $1.8 trillion in spend.

Right. And so yes, these other players have come in and maybe collectively they represent 50 billion in card spend. They're still a micro fraction of that 1.8 trillion. And so, for me it's like, well great. How do I overlay my capabilities over the top of the traditional mean streets. And so, by the end of March of next year, based on what we're implementing right now, we'll sit over about 65% of that $1.8 trillion of spend. Right. And that's really the key here, is I'm trying to overlay my technology on the millions of cards that are already out there in the hands of different individuals and businesses. And so that's how we've focused our growth. And importantly, we've attacked it slightly differently than most.

Lex Sokolin: You've got Brex and Ramp, both kind of Silicon Valley attempts at this category about $10 billion valuation each. And their value proposition was really anchored in software for the CFO or the financial function of a business. And then embedded into the software for the financial function of a business are credit cards that help with spend management for employees.

And so, the permissioning around being able to do this or that, and all of the transactions on these cards rolling up into various streams as you described underneath. End of the day, those are lending businesses with some software on top of it. Your approach has been to go to banks and use the cards that people have. Can you explain what that means? Because just the workflow I imagine from like a ramp perspective is I'm an employee, I'm assigned, you know, this new card number and that's what I use. How does that work on your platform?

Andrew Jamison: Yeah, no. Great question. So, if you think of our biggest partner, which is American Express, right. If you're an American Express business card holder or corporate card holder, you essentially can go and download the Extend application. You go to the web, you can go to a mobile store and download our application, and you're going to use the 15 digits on that card, right, to register your card and will authenticate that you're the owner of that card.

Because again, we've got our plumbing going into American Express, and we work with them to make sure that we can go and authenticate, right. Those different card members. And from that point onwards, those businesses can generate one or thousands of virtual credit cards. Right. And they can ship them to people through just a simple email address. Right. And it can be for, you know, employees. It can be for vendors, it can be for contractors, you know, and by result of that, it's either for me making a spot purchase or is for bill payment, right to go and settle invoices with, with suppliers. But our whole workflow therefore sits over the top of an existing ecosystem. And when that virtual credit card is used by that individual. Right, it goes through the standard authorization process that any American Express card number would go through. Right. So, the processing happens on the American Express side. The decisioning happens on the American Express side. So that's our model. And that's a model that we replicate right across different bank partners.

We have some bank partners that have actually embedded this into a white label solution. Right. So, you download effectively the application of that bank. And I think we'll see more and more of that. In fact, two of the next launches will do with top five banks will be embedded solutions into an existing business mobile application. Right. The idea being that there's no real reason that people should know that Extend necessarily exists. And actually, we can power this solution behind the scenes.

Lex Sokolin: How do you think of the core of the company? Is it payments? Is it, you know, financial management? Who is the purchaser of the platform? Who's the decision maker for your clients?

Andrew Jamison: No. That's great. So, for me, the purchase is always going to be it's the VP of finance. It's that office, the CFO. You know, most of the work we do tends to be in that sort of middle market segment. Again, goes back to there's never been any great solutions, right, for companies with 200, 250 odd employees or less, because they've either typically been too simple or too enterprise like.

And so, the space we play in is, look, we're a software company that's built a platform that has been a little bit different to how most people think about software. And so, there is a graveyard of partnerships between bank and software companies. And the reason for that is really it's actually pretty simple, is in many cases, software companies require you to go and do a whole installation, a whole setup, a configuration of your software, and then you get to the payment. The problem there is sometimes that's a six-month project, and in the bigger software cases, it's much more than that. And so, by definition, the banks get anxious because their salespeople have to earn their own salaries. And, you know, that's where they lose patience, and they go off and go back to sort of doing other loan products and other different things. We led very differently, right? We created our platform specifically to start with the ability to proliferate access to these cards that generated instant charge volume that essentially, therefore went up against essentially the key metrics that banks operate against.

Right. So, we started really with this activation and distribution of cards in under five minutes. Right? No configuration, no software needed to be installed. And so that was a difference. What we then done is continued our journey of helping the office of the CFO by making sure that we overlay right, expense management capabilities. Right. So, the ability to attach receipts, the ability for people to put out of pocket expenses, the ability for the finance VP to review transactions before pushing him into NetSuite or into QuickBooks, knowing that those transactions are correctly allocated to a different department when needed or to the right expense category in the general ledger. Making sure that we can manage and give them a transparent view of where spending is happening right across the organization, be it through vendors or employees or contractors. So, we tackled it a little bit back to front, because we knew that if we were to be successful in this model where we serve banks, we had to start with what makes a bank tick.

Lex Sokolin: Can you describe some of the trends that are happening in the world of the VP of finance? You know, the financial function has been a target of fintech for certainly the last decade. Has there been a change in the profile of what a purchaser expects? Has there been a change in the expectation of the experience. And what kind of transformation are you seeing there more broadly? Like are there more API enabled services? Is it easier to integrate now? You know, what does the future version of the CFO function look like?

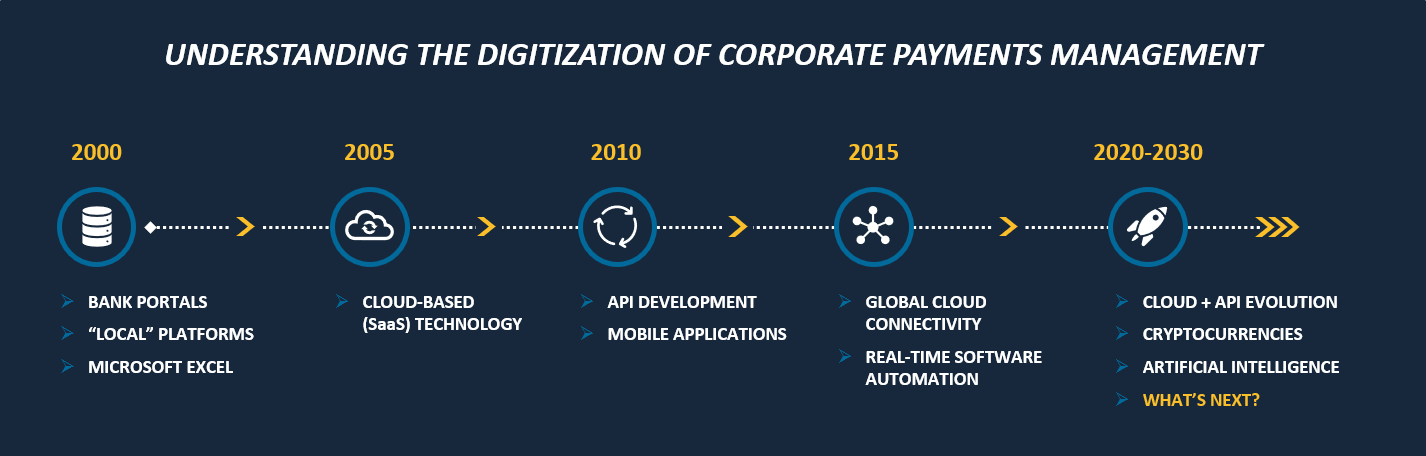

Andrew Jamison: So, I love the question because I've just been talking about this actually at a conference this week, and a very similar question was asked. And I think we're at this really interesting intersection. The reason why is people forget, right, that digitization is still relatively new. Right? I sort of like someone said to me, like, what's the technology that's sort of most impacted you as you've gone through business and needs to go through? And, you know, everyone talks about AI. It's like, damn it. The AI term was coined in 1956. Right. And at a Dartmouth conference. So, so this concept of data is really not that new.

And it needs to go back and say was it the iPhone in 2007. Was it, you know, the e-commerce in the 2000. Was it the internet in 91? The reality is, what we all fail often to recognize as all of this is, is relatively new. And so obviously the place where we've gone first is consumer. Right. And so, a lot of applications on phones and embedded payments is a real thing. Right. And I think the use case everyone talks about is like, you know, you're getting an Uber because you want to go from A to B and you get out and you don't even have to think about the payment. It's part of it's part of the service. Hence why I think many of us then stepped out of yellow cabs without paying, because we totally forgot that there was a different action that had to happen as part of your trip. So, to your point, I think what's happening is, is a confluence in my mind in the digitization of software and payments.

Right? The US is a little bit of a different beast. There are still billions of paper checks out there, but you have to go back further to think that actually most technology platforms are business use, you know, still sort of on prem. They've not moved to the cloud, but this whole shift to the cloud, right, is facilitating the deployment of technology and the speed of an impact and the speed at which we can deploy technology. We're moving away right from batch right to individual event driven transactions. Right. Because you think of check runs, ACH runs, they're all batched. And now we're sort of like seeing no. With SaaS it's all happening real time user service. You get charged instantly. So, I think between that and then the digitization of payments from paper checks to really sort of more real time payments, then also to virtual credit cards, you now have this collision happening of these, this evolution in digital. And because of the complexity of businesses, which isn't as simple as like, it's me, I choose my bank, I choose which phone I use and that's it.

I go right here. We're talking about companies that choose sometimes one platform because I'm small, it's QuickBooks, but then maybe I'm bigger and I use NetSuite for my ledger, and maybe I use another procurement tool all the way through to the SAP of this world where really large global enterprises use a myriad of different tools, and so complexity just continues to scale. Nonetheless, it's all right moving into the cloud. So, I think that's why embedded payments in the context of B2B is the next frontier. And it's really starting now. And that's, I think, a place where we feel we have a really interesting role to play, because inherently today we sit between the technology of the banks and the companies and our software layer. But actually, more importantly, our middleware layer is really what's interesting here. Why? Because we've connected banks on the one side. Right? And then we've gone and connected effectively also into some software providers. And we signed a partnership with SAP Concur Invoice. And we'll be going live with that in the next couple of weeks.

The idea being there, by the way, that SAP concur invoice like, I'm sort of frustrated because I want to be able to embed credit cards into my application, but every bank issues cards in a different way. And we said, well, we actually have a solution for that, right. Because we've built that intelligent middleware layer, right? Goes back to the logic tier, where as long as you're a bank partner of mine, I've taken care of the fact you may be on process A versus process A B if your network A versus network B, and essentially I've been able to now present a unified API that I can point to SAP concur invoice and say, we can now do this. And better still, we can be completely invisible, right? Intel inside in that operation. So what's happening with these first customers is they're going to be able to go into the application, and we're going to be launching this with BMO as our first bank and effectively be able to register their credit card again in their wallet and essentially then be able to settle invoices to individual suppliers on virtual credit cards.

All of it's going to happen within the one cockpit, and that's going to be the Concur Invoice cockpit. And we think that's going to be the first of many experiences. And that's where the office of the CFO and everyone wants to do is help me be where I'm already doing business. It's not a banking application. It should not be a third-party application. It should be happening in the core of the systems where I look at my entire business. Right. My wife's a CFO and as I said, do you ever go into concur? I know I go into the general ledger; I go into NetSuite; I go into SAP because that's where I see the entirety of my business. When I think about reporting and insights.

Lex Sokolin: I do hope that we get to this destination sooner rather than later. If our audience wants to learn more about you or about the company, where should they go to find out?

Andrew Jamison: LinkedIn is always a great place. I'm easily accessible through LinkedIn and also, they can come to paywithextend.com not to be confused with extend.com which is an insurance reinsurance company. But again, always happy to talk to customers and people who are interested in this space. You know I go back to my consultancy roots, right? I love talking to customers who have unique challenges as they think about sort of how they reconcile their business process with payments and different things happening in the industry. So always, always happy to engage in those discussions.

Lex Sokolin: Fantastic. Thank you, Andrew, for joining us today.

Andrew Jamison: No, thanks for having me on the show. Really appreciate it.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post