Hi Fintech Architects,

In this episode, Lex interviews Arun Kumar, the CTO of Socure, an identity management and risk assessment company.

Notable discussion points:

Arun's experience building large-scale, high-throughput, and low-latency systems at companies like Amazon and Citadel, and how he applies that expertise to the identity verification and fraud detection challenges at Socure.

Socure's rapid growth, serving over 2,700 customers including 9 of the top 10 U.S. banks and over 30 state agencies, processing hundreds of millions of transactions per month.

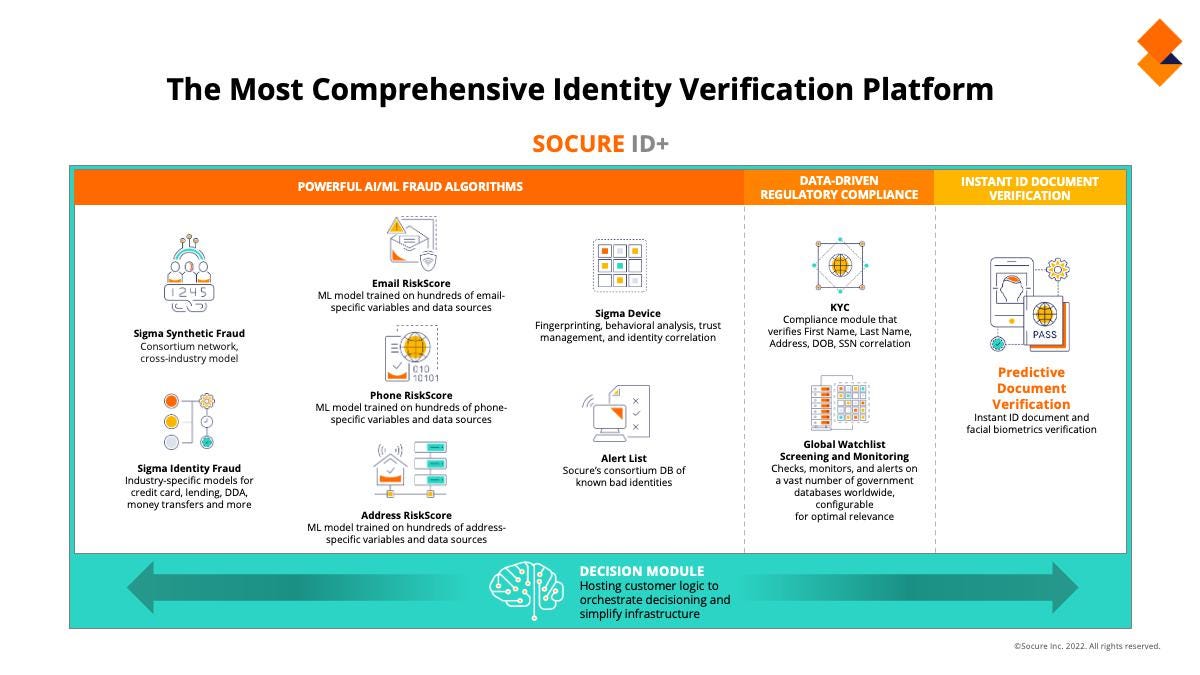

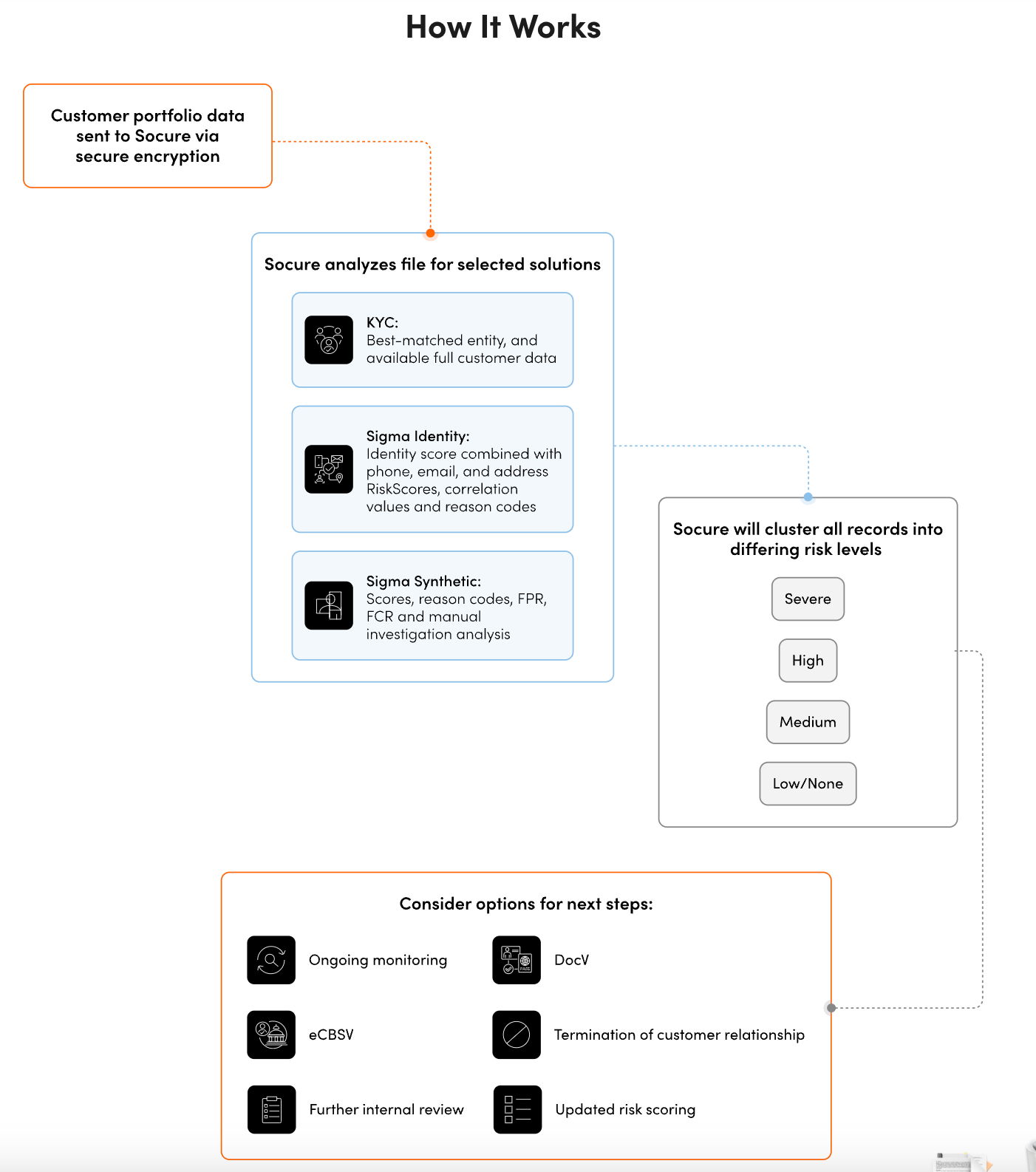

Socure's approach to building a real-time identity graph by aggregating signals from devices, phone numbers, IPs, and other data points to detect and prevent sophisticated fraud tactics like deepfakes and fraud GPTs.

The company's recent acquisition of Effectiv to simplify the integration process for customers and improve efficiency, as well as its use of Generative AI to automate various tasks.

Socure's future plans to expand beyond account opening and login into transaction monitoring, as well as exploring opportunities in the growing embedded finance and digital identity spaces.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Connect with thousands of fintech professionals, showcase your innovations, and be part of the industry's biggest event of the year. Maximize ROI with our groundbreaking meeting technology that delivers measurable results.

6,000+ attendees

450+ Sponsors and Exhibitors

175+ Speakers

60,000+ one-on-one meetings

100+ co-located events

Make sure to secure your ticket before the prices increase on Friday!

Background

Arun Kumar is an experienced technology leader with a strong background in computer science and leadership roles across various prominent companies.

Currently serving as the Chief Technology Officer at Socure and Luma Financial Technologies, Arun has previously held significant positions such as Senior Managing Director at Citadel LLC and Senior Leader for the Real-time Fact Extraction Machine Learning Platform at Amazon. Arun also served as the Global Head of Development at Thomson Reuters.

Arun’s academic credentials include a PhD in Computer Science from The Johns Hopkins University and a Bachelor of Engineering (BE) in Computer Science from Sri Chandrasekharendra Saraswathi Viswa Mahavidyalaya.

👑Related coverage👑

Topics: Socure, Effectiv, Citadel, Amazon, Identity management, digital identity, generative AI, deepfakes, fraud prevention, machine learning, identity verification

Timestamps

1’02: Scaling Innovation: Exploring High-Performance Systems and Real-Time Technology

4’04: From Financial Data to Machine Learning: Scaling Systems and Solving Edge Cases

8’49: Bridging Big Tech and Quant Finance: Exploring Technology Overlaps and Ultra-Low Latency Systems

11’12: Protecting Digital Identity at Scale: The Journey to Socure and Solving Real-Time Fraud Challenges

15’50: Building the Network Effect: How Socure Became a Leader in Identity Verification and Fraud Prevention

21’00: Battling Modern Fraud: Deepfakes, Generative AI, and the Evolving Landscape of Digital Security

26’30: Revolutionizing Customer Success: Simplifying Integrations with No-Code Solutions and Real-Time Performance Insights

29’57: Scaling Customer Integration: Fixed Costs, POCs, and Generative AI-Driven Value Propositions

34’00: Driving Efficiency and Scale: Socure's Evolving Product Roadmap and Future Vision

36’14: Learning from Customization: Standardizing for Scalability and Long-Term Growth

38’58: Expanding Horizons: Growing Market Share and Addressable Markets in Digital Transactions

41’00: The channels used to connect with Arun & learn more about Socure

Illustrated Transcript

Lex Sokolin:

Hi, everybody, and welcome to today's conversation. I'm really excited to have with us today, Arun Kumar, who is the CTO of Socure. Socure is one of the most successful identity management and risk assessment companies in FinTech, and I'm really excited to learn more about it as well as to talk to Arun about his journey. With that, Arun, welcome to the conversation.

Arun Kumar:

Thank you, Lex. Really, really excited to have this conversation with you today.

Lex Sokolin:

Fantastic. So, one question I have about your career, because you've done a lot of high-profile stuff, is to ask what kinds of systems are you interested in? What kinds of structures do you like building?

Arun Kumar:

No, that's a really, really good question over there, Lex. I love building very, very large-scale systems. I mean, one such example is when I was at Amazon, one of the systems that we built on the consumer side was scaled to 100 million transactions per second for operating for Prime Day. Again, when I went into Citadel, of course, we were dealing with some very, very large-scale systems in being able to scale to the volumes of the stock exchange. So, those were some really, really interesting problems to solve.

So, really, high throughput, low latency systems is something that gets me really excited, but then layering on top of it, I get really excited by using machine learning and deep learning on top of these systems, and scaling those type of systems to be real time is something that I'm truly, truly passionate about from a technology perspective.

Lex Sokolin:

How did you get into the position to be able to take on these big challenges? What was your path into the first one of these that you had to deal with, and what were some of those early lessons?

Arun Kumar:

No, my career started with Bloomberg where, again, dealing with large scale financial systems, I was thrown in on the deep end of being able to figure out how to run low latency systems, how to run real-time interactive systems that are highly responsive. There's a whole different element when you're dealing with humans that are interacting with systems versus systems interacting with systems because there, your latencies need to be so low, and you need to be able to operate at such high transaction volumes.

So, I got the flavor for it when I started my career at Bloomberg, working on a variety of different teams over there, and that's truly where I found my passion. I started off as a software engineer working very, very deep in low latency systems over there. It's just something that I've honed over many, many years now, and just continuing to operate in these really, really hyper-scaled environments.

Lex Sokolin:

So, you spent over a decade in and around financial data and then moved to Amazon. It looks like there was the emergence of machine learning at the time. What was it like to go from delivering information to trying to, I guess, connect to human behavior in a way?

Arun Kumar:

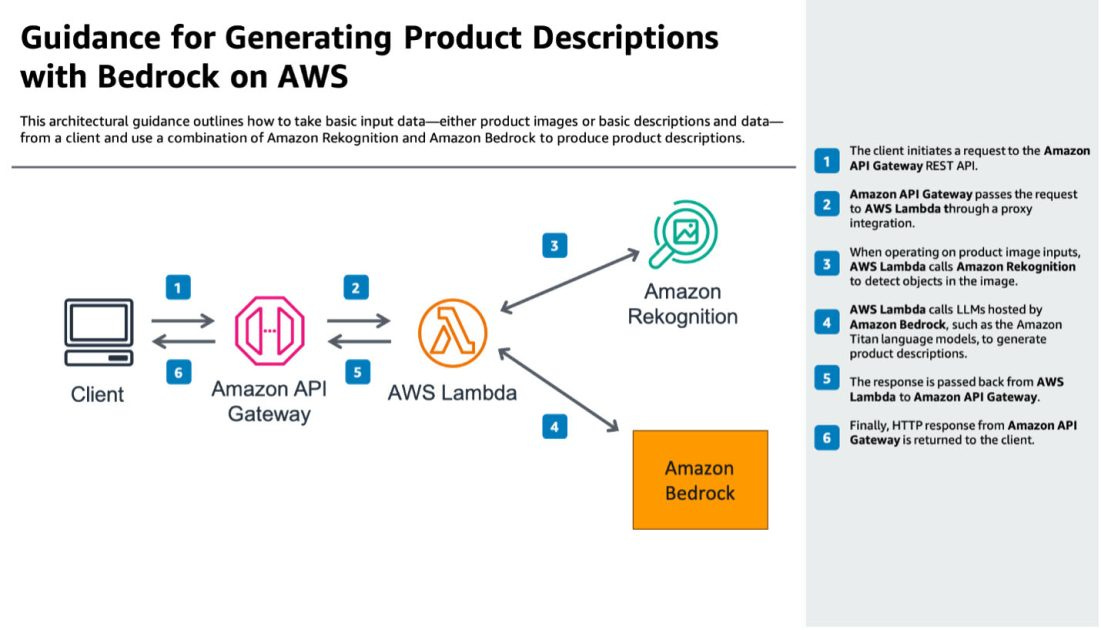

That's a really interesting question there, Lex, where I saw that we're just so many overlaps. If you think about Amazon.com, I mean, when I was there, we had tens of billions of products in the Amazon catalog, and you had these billions of customers that were shopping around for a variety of these products. It's a very similar set of challenges in terms of whether you're surfacing stocks and stock prices versus products and product pricing information, and finding the best deal possible, which will really optimize for shipping and all these other factors and being able to get the best price to a customer.

So, there were some very, very interesting overlaps in the financial services world to the world of consumer goods and really operating at that size and scale. I think what was really interesting there, Lex, was understanding the fact that there's just these similarities, but then there were a lot of things that we even did at Amazon that really needed to be scaled up. For example, we're using a lot of machine learning, and trying to find out different attributes of a product. As a simple example, on the Amazon catalog, you're selling, say, pens versus cans of Coke.

Now, as a seller, we would just get descriptions of the product that were being sold, and images of the product. So, we had to use a lot of machine learning to understand that this was a pack of 12 pens, and this is a pack of 10 cans of Coke, but then the measurements are very different because a can of Coke could have 300 millilitres of liquid in there, whereas a pen, you're not really measuring it in that dimension. So, using machine learning to be able to extract all those facts at scale was a really, really interesting problem for us to solve. Then scaling that system to the levels that I talked about. 100 million transactions a second was just a really, really interesting twist on that problem, if you may.

Lex Sokolin:

When you have to work at the scale, are you thinking about specifics, or are you thinking in the abstract? I can imagine you create some solution that works for 99% of these billion people, and then at the edges, there's 100,000 that are lost in edge cases you could never have predicted. How do you design both at that hyper scale, but then also figure out the human experience?

Arun Kumar:

No, you really hit the nail on the head with that, Lex, where when you're building these core systems, you do really build for these. You're never trying to build a solution that's going to work for 100% of your use cases, because then you end up in this vicious cycle of trying to build for every possible use case, and it's just impossible to do that. So, what you typically do when you're building these types of systems is to really go for the set of 90, 99% of your use cases, and then take a different tack or a different approach towards solving for that exception set of use cases.

That exception set of use cases; you're not really looking to build those at scale. You're really looking to go very, very deep into those exception use cases. I mean, we had this challenge for example, at Amazon where we had to deal with customizable products or products that could be tweaked in different ways, or we had this other challenge where there are products that are being sold as bundles. So, we chose to deal with those kinds of products and these products on the edges with a completely different set of systems, because obviously because they're on the fringes, you need to think about it in a different way where you're really going into the detail, but not really thinking about scale because that's your 1% problem. That's your 0.1% problem. That is not your 99% problem.

Lex Sokolin:

So after Amazon, you went back to finance with Citadel. I'm curious as to how much of the software stack overlap is there between the big tech firms and then leading quant shops like Citadel? How similar or different was the technology and even maybe the development process?

Arun Kumar:

So, there were two aspects of this, Lex. There were certain problems that Citadel was solving that nobody in the world really was solving. So, this is sub-millisecond latency problems. At places like Amazon, you're dealing with a lot of consumer-based transactions where your latency is... I mean, the human eye can only respond at a certain rate, so to the point where you can press something on the computer. So, the minimum latency that you can ever get to with a human is about 20 milliseconds. So, with these systems, you are dealing with sub-one millisecond latencies. This is for all these high-frequency trading use cases.

There, we really had to go deep at the hardware level to think very differently about how you solve for those problems. But then we also had other use cases where we're bringing in massive data sets, whether it's weather data or consumer spending data and things like that, where you've got these massive, massive data sets, and you've got to do some very similar things with those data sets to be able to glean some patterns from it to be able to extract information, and be able to make trading decisions off of it. So, there were two types of problems. I would say one set of problems where you're dealing with these very, very large data sets to glean insights, and make trading decisions.

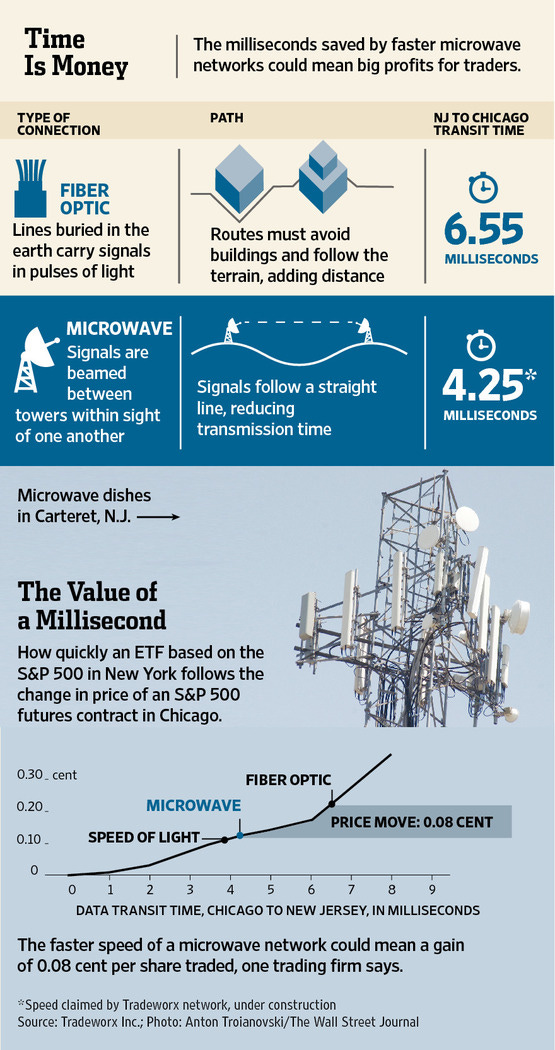

It was very similar to the problems that we were solving at Amazon. But then when you go into this whole low-latency space, it's a very different set of problems where you're trying to micro-optimize where it's like, "Okay, the speed of light through fiber is not fast enough for you." So, then you start setting up microwave links to be able... Because microwaves travel faster through air than light does through glass, so it was just a different set of problems over there in that low-latency space.

Lex Sokolin:

That's really interesting and masochistic. So, what pulled you towards joining Socure? How did you find out about the company? Then maybe we've gotten a sense for the types of large-scale issues that you build around. Draw for us the parallels for what that problem is.

Arun Kumar:

I'll start with how I even found out about Socure. So, one of the investors in Socure was closely connected with our CEO, and I was closely connected with them as well. Then they introduced me to our CEO, Johnny, a couple of years ago now, and we connected. I was really not exposed to this whole space of identity and identity verification, but as we started talking about, it again became a very similar set of problems that Socure is solving to what we were solving at Amazon for the catalog. If you think about it, there's billions of people in the world, about eight billion people in the world.

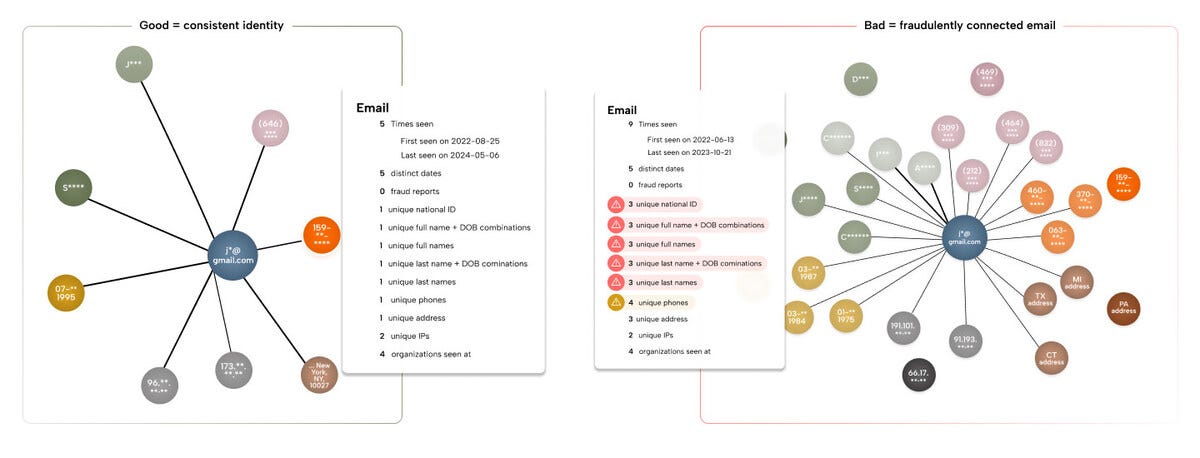

There are billions of devices in the world, and there's all this real time activity that's happening. As technology is getting more and more accessible, fraudsters are getting smarter and smarter every single day. The key was to build this identity graph of everything in the world, whether it be some of the core identity elements, and then phones and phone numbers and then device and device profiles. So, then you're able to tell things like, "Wait, this one device was used to log into 1,000 different identities." Now, that's not a very practical use case or a scenario for a genuine use case, and it's a very high likelihood of fraud happening in those type of use cases.

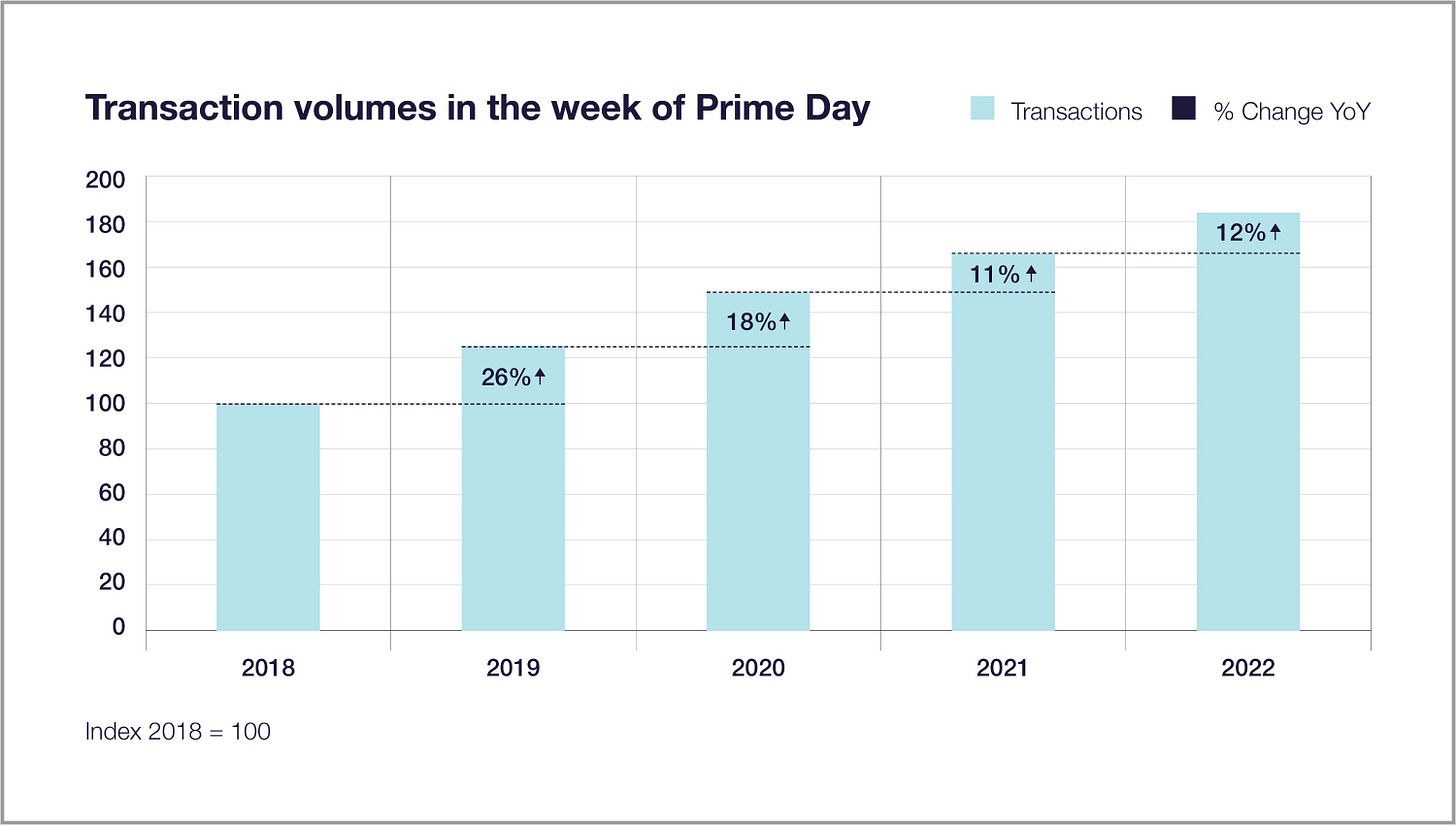

To be able to build this real-time identity graph where it's constantly getting this information from a variety of different elements of activity over the internet, and if you look at it like transactions, I mean ever since the pandemic, I mean, this has really skyrocketed in terms of transactions in physical stores versus transactions that are happening online. Directionally, this is only going to keep increasing, and the attack vector continues to increase. So, the engineering problems were really, really fascinating. But I think beyond that, something that really struck a chord with me was this has true impact in the world in terms of protecting every single person's digital identity.

That got me really, really excited in terms of the mission of the company, and what we could accomplish in terms of protecting every single transaction in the digital universe.

Lex Sokolin:

Help us get the sense for how big the company is.

Arun Kumar:

Sure. So currently, we've got about 2,700 customers across a variety of different dimensions. We cover nine out of the 10 top banks in the country. We work with over 30 state agencies. We recently closed a contract with Login.gov that's going to be powering a significant number of all federal agencies. So, in terms of breadth and scale, we're really, really expanding out in so many different areas. These two-sided consumer marketplaces, I mean, that's another area that we're rapidly expanding.

Then from a volume and transaction standpoint, if you look at it, we hold tens of billions of records on identity elements. Then from a transaction volume standpoint, we deal with hundreds of millions of transactions every single month. So, if you look at all of these put together and building this real-time identity graph that's powering all our decisioning, I mean, the scale really gets there. Today, we're mostly operating at that login and account opening space, and we're starting to make inroads into the transaction monitoring use cases where that scale is just going to go up by 10x or 100x as we start going into the transactional volumes.

But in terms of size and volume and scale, we're really up there in terms of just being able to put all these signals together to be able to detect these fraud rings in real time. Then company-wise, size-wise of the organization, we're at about 450 employees at the organization, which also makes it really effective for us to be really small and agile and nimble to be able to attack these problems.

Lex Sokolin:

I think the last big funding that you had was in ‘21 with a 450 million round at a four and a half billion-dollar valuation. So, I think there's been some more capital that has come in since then, but quite mature as a company. How did the company get built to have this position in the industry? If you are the identity solution for the government or if the banks themselves are outsourcing this key function to you, tell us a little bit about what it took to go to market, and what were the key levers to get to the scale?

Arun Kumar:

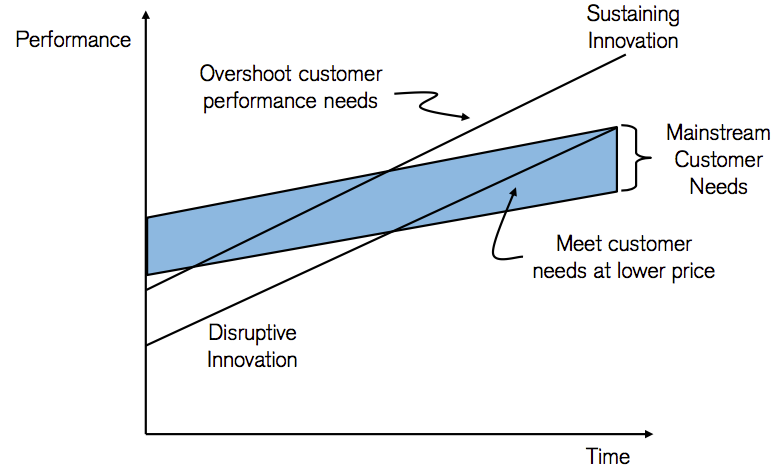

I think what we did as a business strategy was really smart here, Lex, where we started off with some of the biggest names in the industry. We started off with some of these really, really large names like the large banks for instance. We started there in really working closely with them and identifying where they weren't able to move fast enough, where we could move so much faster being a startup, being able to build these models. What was interesting was, I mean, Socure started with a very large percentage of the workforce being data scientists.

So, that was a very heavy leaning towards building these really complex models on top of the data to be able to decision very quickly and be able to make much better decisions than what these banks were able to pull together in a short period of time. So, I think that really helped us in gaining momentum. Then after we got the first set of banks, we were able to see enough transaction volume, and I think that's really our differentiator is this network effect. Now, each one of these banks, they only see their own transactions.

Now, if you have someone who's seen the transaction across nine of the top 10 banks, you're pretty much seeing every single consumer in the United States. You're seeing every single transaction go through. So, you're able to detect a lot of the fraud that's happening because you have this network effect going into the organization. It just creates this flywheel whereas we acquire new customers, we're getting better and better and better. It just helps us make even more compelling decisions in terms of where there's fraudulent transactions versus not.

Lex Sokolin:

So when you say you're seeing it across multiple banks, it's like you're seeing an IP that's persistent across somebody logging into Bank of America and JP Morgan. What does it actually mean to have that identity graph? In which way are you able to go across the different data points?

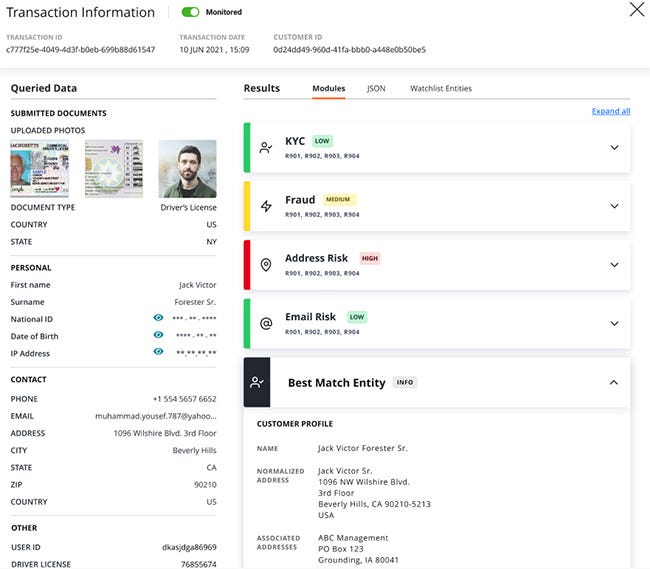

Arun Kumar:

No, absolutely. There are, Lex, easy ones. Phone numbers, for instance, if the same phone number is being used in combination with a thousand different emails, that's a significant risk signal for instance. We see devices, so we're integrated into the front page of most of these banks, for instance, or within their apps. So, as we start seeing different devices, it's like, "Okay, I'm seeing this device with the same set of PII information." Whether it's social security number or their first and last name or the device they're associated with or their phone number and address, we're able to pull all of these signals together, and then IP address being one of them, but we use so many different data points that we pulled together where we're able to say that, "Okay, this is truly this person's identity."

So, if we usually see Lex on one laptop and on two mobile devices and maybe an iPad, but then all of a sudden, we see Lex now logging in from an Android device, whereas Lex is typically an Apple user, that's a risk signal. Then we start seeing that we see you from Comcast usually, but now we're seeing you from a different internet service provider on a completely different set of IPs in a completely different geolocation. That starts elevating the risk profile. Then if we start seeing Lex associated with this phone number that was used with these thousand other identities, then again that starts raising that risk profile.

So, we're able to immediately raise some of these flags. There are different ways in which banks will deal with the elevated risk factors, whether it's like sending these one-time pass codes to your phone to verify that you are who you are or having to do some level of document verification and things like that. So, those are some of the ways in which we prevent fraud.

Lex Sokolin:

I'm curious as to what are the most common attack vectors that you are preventing. I'm also curious how that has changed over time since the company's founding, because I'm sure that things have gotten a lot more sophisticated, but are there types of activities that you're seeing all the time?

Arun Kumar:

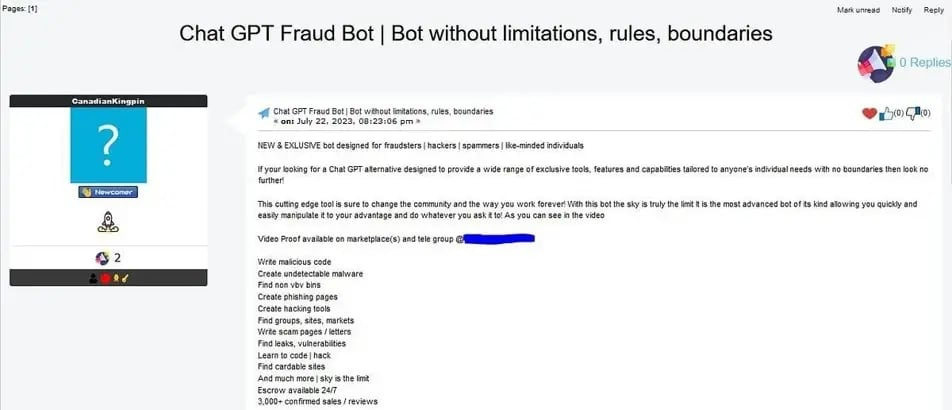

It's just amazing, Lex. You look at technology being accessible to these types of good behaviors, but then it's just as equally available for bad behaviors. So, one of the recent things that we saw in terms of pattern was now there's these things called fraud GPTs that are available in the dark web for fraudsters to be able to carry out these attacks. There's TikTok videos that show people how to commit fraud, so that's rampant. Then the other thing that we see a significant pattern around is using deepfakes.

Recently with one of our customers, we saw that the same image, the same face, the same profile was being used across about 1,700 different drivers' licenses where this fraudster had created images of these different drivers' licenses across so many different states, and just bolted on various personally identifiable information elements on it, and then used their same face, and was using a deepfake video because a lot of these applications will also do self-reverification. But because, again, we were able to see that same image vector across so many different dimensions, we were able to quickly identify it and block it.

So, it's just really interesting in terms of how fraudsters are getting more and more sophisticated. So, then we also put measures around when they're using deepfake videos, you can use things like detecting the accelerometer on your phone to see if the person's... It's just tied to a certain device, and are you moving your phone around, and then typing patterns and things like that? But I'm sure they're going to get smarter and smarter in figuring out ways to move the device while they're doing it, so we're constantly having to evolve.

One of the things that we're doing in more recent times is this concept of a red team where we're constantly coming up with new fraud patterns, so we can mimic some of these fraud behaviors. So, we can constantly stay multiple steps ahead of how fraudsters are taking advantage of the situation of technology being just so accessible.

Lex Sokolin:

How do you see that evolution of deepfakes and Generative AI? How feasible or easy is it to spot this stuff, or is it going to run away at some point, you think?

Arun Kumar:

One of the bigger pieces over here, Lex, is as things get more digitized and automated, we're able to put more protections in. If you look at, for example, this whole drive towards mobile drivers licenses, because then you're verifying a digital identity and the device that it's tied to, and there's much better security measures that you can tie along with that versus having a physical document, which is only getting easier and easier for somebody to replicate that in the digital world. So, I think that move and shift towards digital identities is going to be so key and critical and having this concept of digital wallets and digital identities with more and more sophisticated biometrics that we use in order to authenticate an identity.

Unfortunately, though, there is a significant proportion of the world that is still relying on these physical elements of identity that make it much harder with how deepfakes and Generative AI are making it fraudsters to be able to conduct these attacks. So, I think that's one element of it, but I think having this network effect is a really, really powerful way to combat it, because, again, there's not a lot of... You've got to raise the bar and the cost for committing fraud. So, the moment you start detecting that, "Okay, a single device that's committing fraud across so many different areas is no longer feasible, because it gets really expensive, and you're able to block it very easily."

Now, fraudsters are going to have to buy hundreds of thousands of devices. Then as they start doing that, they've got to go onto hundreds of different networks, for instance. So, you start to keep raising the bar for committing fraud that it gets harder and harder. So, we are constantly looking at ways in which we use Generative AI and deepfake detection technologies to constantly stay multiple steps ahead.

Lex Sokolin:

I'm still quite interested in the shape of the business and how you acquire customers and then also how you serve customers. Maybe we can talk about the latter first, which is of the customers that you have, what's the shape of the organization to support them and to maintain the integrations? Do you need to have lots of solution architects? Is integration very manual, or is it completely productized? What does customer success look like? Can you talk about that aspect of it because such an important function for the businesses?

Arun Kumar:

Absolutely, Lex. Actually, this dovetails very nicely into our recent acquisition of Effectiv. That was one of the biggest pain points that we saw with a lot of our customers where it required significant amount of engineering effort for our customers to integrate our products and solutions, because most of our solutions are API based, where a customer has to go to our APIs, integrate with it, and then whenever they wanted to make any changes in the way in which they were calling our APIs or calling it at various points within their integration points, it was pretty manual, required a lot of heavy engineering lift.

Now with the acquisition of Effectiv, Effectiv provides a solution where it's very similar to the concept of what Shopify or Stripe did in the payments industry or in setting up these e-commerce websites where it's like two lines of code. Now, you're able to do all of your payments processing without having to directly integrate with Visa and MasterCard and all these different providers. That's really what Effectiv did for us, where they really have this couple of lines of code drop it into your integration point, and then everything is managed in this no-code solution, which is all UI based. So, you no longer need engineers to be able to configure a lot of these blows and configure some of these models to make them really, really customized for their specific use cases.

So this, we're looking really, really excited about bringing Effectiv in to accelerate the pace of deployment, and lower the cost per a customer to integrate us, and then also from a solution consulting standpoint from our side as well to help them with their implementations, because everything now gets configured in the UI. Then one of the other challenges for a lot of our customers historically was they would have existing solutions or homegrown solutions that they would've built historically. So, how do you empirically show that Socure solution is performing better than the previous solution?

So, they would have to integrate in such a way that they were then capturing metrics of running us in shadow mode, and then running their current solutions, and then comparing the results, and then flipping it over. Now, with this integration of Effectiv, we're able to do all of that behind the scenes where you can look at all the results on this Effectiv dashboard. You can look at their live transactions. You can look at our transactions, and then see how much of a lift we're able to provide to them in eliminating fraud or massively reducing the number of fraudulent use cases they let in. Then also saying yes to good customers that they said no to, because we're seeing good behaviors across some of these elements, across our network, across our consortium of customers.

So, this, we're really, really looking forward to this integration, radically simplifying our ability to integrate with new customers and with existing customers for them to be able to configure their flows.

Lex Sokolin:

How does this scale up when you add new customers? Is it chunky and you have to add to this part of the business, or is it a fixed cost?

Arun Kumar:

No, it's really a fixed cost over there because... As I was explaining, Lex, with the Effectiv acquisition now with even new customers, instead of them today requiring tens if not hundreds of engineering hours to do the integration, it's going to take all of 30 minutes for an engineer on their side to integrate us. Now, that massively reduces the amount of engineering effort on their side. So, when we talk to new customers, we're able to say, "Look, this is two lines of code. Drop it into your engineer... I mean, your integration points, and that's it. You're off to the races."

Versus historically, it's like, "Oh, here's the developer documentation. Here's all the different steps you need to do. Here is the API that you need to code to." So, we just massively simplifying the integration, so even the fixed cost starts coming down as we start rolling out this combined Effectiv-Socure product out to the market.

Lex Sokolin:

Then that second part of the question around going to market and acquiring new customers, what's the sales motion? How easy or difficult is it? How long does it take to close a customer? You have to prove to the enterprise that you can fulfill the product promises. Is it very hands-on, or has it become more automated over time?

Arun Kumar:

Something that we do that's pretty interesting with a lot of the large customers to really truly prove value, again, in a very empirical way is what we do is we run these things called POCs or proof of concepts, where what we'll do is take their historical transactions over, say, the last six months or the last year. Obviously, they have data on which of these were fraudulent, which of these weren't. We'll get these labeled data sets working closely together with their data science teams of saying, "These are the customers that they said yes to, but they turned out to be fraudulent. These are the customers that they said no to, but they have no idea if they would've turned into fraudulent use cases or they were genuinely good customers, but they were thin file customers that they just didn't have enough information on. So, they ended up saying no to them."

So, then we take that data, run it through all of our systems. We do the analysis to say, "We would've said yes to these customers, and we would've said no to these because we saw fraud in all these different use cases. This is a business value and proposition of the fraud losses that we would've prevented for them if we were plugged into their enterprise solution. Then these are the number of customers that we would've said yes to, so there's so much more in revenue for them." So typically, when we do this analysis, we find that... I mean, there have been cases where we've shown a lift of hundreds of millions of dollars for these large customers, where they said no to a number of these users that they could have potentially said yes to and had so much more in revenue.

So, that's a big part of our value proposition. So historically, a lot of generating those decks, doing the analysis was all very manual. Now, we've used a lot of Generative AI to be able to automate generation of all this analysis. So, it makes it very turnkey for us to be able to take that data in, process that data, and get the results back to the customers. So now, they're able to see the value much faster than historically, we would run these massive jobs over a period of time, and then do the readouts to our customers.

Lex Sokolin:

You mentioned this transition from the account opening, the initial identity verification towards transaction monitoring. Can you paint a picture of the product roadmap? Where did you start, and how is it developing over time and where do you see the product going in the future? I mean, you already have a pretty broad platform and a pretty sticky asset in terms of that reputation graph. What does the company continue to evolve into overtime?

Arun Kumar:

I think if I had to summarize it in one word, Lex, it's all about efficiency, and actually two words, efficiency and scale. So, we're constantly looking at ways in which... Our cost of customer acquisition, for instance, I mean historically, it's been very high touch where there's just multiple interactions with the customers in order to acquire a particular customer. As I was explaining, there's a lot of manual elements that we're looking to completely automate. Even from an engineering perspective, we are looking at ways of being much more efficient in the way in which we do things.

So, there are several teams now that are operating about 40, 45% more efficiently than they were before when we look at our sprint velocities and things like that. It's all because we're using Generative AI, for example, to generate all our test cases for the engineers, or from a standpoint of solution consulting, as I was saying, simplifying these integration points because it becomes so much easier now for you to implement our solutions. Then we've used Generative AI to also do a lot of work around understanding where, say, we say no to a particular use case, and then we're able to quickly generate insights into why we said no using Generative AI versus having somebody on the customer support team go really deep and expose some of the logic behind why we would say yes or no to a particular transaction, for instance.

Then also from a scale perspective, we're starting to look really, really deep into our code base to see how we run so much more efficiently with our code to be able to continuously lower the cost per transaction on our side, so we can truly go into this transaction monitoring space, and really not pass that onto our customers. As we keep increasing our efficiencies, we're able to pass that back onto our customers as well. Everybody wins as a result. So, a big, big, big piece of this is all about how do we continue to grow this while we keep improving our efficiency, and keep increasing our scale at which we're able to operate?

Lex Sokolin:

Are there parts of the business that maybe didn't work as planned or where you had made strategic mistakes and then corrected them? I mean, everything so far sounds invincible, which is amazing. What were some of the stumbling blocks maybe that you came across and learned from?

Arun Kumar:

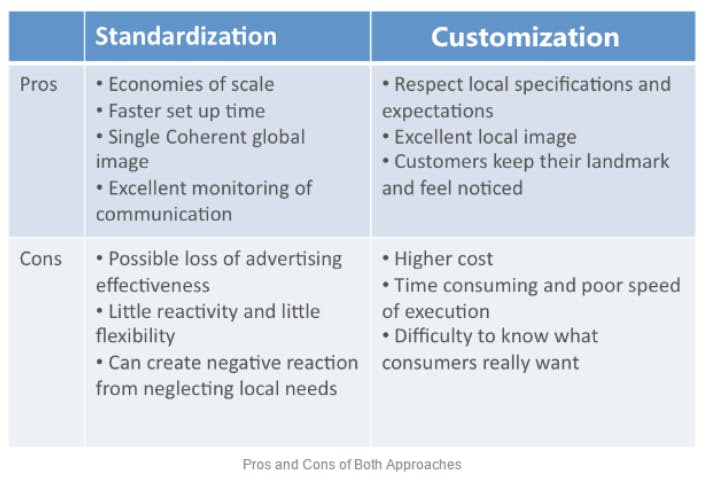

I think this is true of any startup journey, Lex, where for a lot of the initial customers, we went and bent over backwards in fulfilling some of their needs where we built custom solutions. That always creates issues because... I mean, recently, we had an issue with one of our customers where we built something so custom and bespoke, and that custom bespoke implementation broke. There was literally nobody in the company who even knew what that implementation was or why that implementation was done, because it was done eight years ago, and nobody who was even associated with that specific implementation is no longer with the company.

So, I think that's one big piece around standardizing how we approach things. You, of course, need to do that in your early days to do a lot of this custom bespoke implementation, but it really comes back to bite you when you're looking to grow and scale. The more custom one-off things that you do, the more there's a chance that nobody even knows why that was done or how that was done. So, I think we are going through this exercise now of unwinding a lot of these custom things that we did, having those dialogues with those customers to say, "Look, it's creating a risk on both sides, right?"

Because the more of these customer implementations you have, the more the teams have no knowledge of these and maintaining that where you're one out of the 2,700 customers that have this implementation, and it just adds the complexity to how you grow and scale. So, I think there is a significant amount of work that does need to go into simplifying and standardizing our entire stack to be able to make sure that we're serving everyone in a consistent way.

Lex Sokolin:

Absolutely. What do you think the shape of your clients looks like in the future, especially as we project further and further out and deepen the product stack? You already have pretty significant market share. Do you expect for things to start including more big tech firms? A big part of the embedded finance thesis, for example, is to define financial products all over the internet. How do you think about growing the total addressable market as well?

Arun Kumar:

No, absolutely, Lex. Even today when we look at the number of financial transactions that are going on over the internet, we today cover barely about 1-1.5% of all the transactions that are going through. So, we're still covering a very tiny segment, even though we're a pretty significant player here. I think the next big step, as you point out, is definitely these large e-commerce marketplaces where you just have such large volumes of transactions going through, and how do you validate and verify and ensure that every one of these transactions is legitimate?

Even on the government sector side, I mean, we all know during the pandemic with the small business administration, these PPP loans that were being handed out, there wasn't a lot of scrutiny. There wasn't a lot of validation. So, I think there is a need across a lot of these large use cases where there's significant financial activity to be able to provide that layer of protection. So, I think that's a significant area of growth for us in just looking at where the industry is moving, and where these financial transactions are happening.

There's more and more of these platforms that are starting to enable various ways to do payments and transactions, and how do you protect all of that? So, I think that's one of our key areas of growth is just going where the industry is moving in terms of where these financial transactions are happening.

Lex Sokolin:

Absolutely. I think not only are things getting far more financialized, but people are also much more used to transacting in places that they never would have before, taking out loans where they never would have before. I think that behavior is only going to accelerate. Well with that, I want to ask if our listeners want to learn more about you or about Socure, where should they go?

Arun Kumar:

I think the easiest would be just reach out on LinkedIn. I'm very, very responsive over there. That's probably one of the easiest places to reach out and connect. I'm more than happy to engage with anyone who has thoughts or ideas or just wants to talk through something or has questions. More than happy to answer there.

Lex Sokolin:

Fantastic. Arun, thank you so much for joining me today.

Arun Kumar:

Absolutely a pleasure, Lex. Thank you so much.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post