Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Jeff Keltner, the SVP Business Development at AI-powered digital lending fintech, Upstart. Jeff joined Upstart in 2012 after spending 6 years at Google. He launched and built the Google Apps for Education business, growing market share from zero to almost 70% in its first four years. Jeff spearheaded marketing efforts for Google Apps in Global 2000 accounts and led sales, business development, and go-to-market strategy for the launch of Chrome devices in the education and enterprise sectors.

Jeff spent several years in direct sales at IBM, always exceeding quota, and was a founding engineer and lead UI developer at SSB Technologies. Jeff holds a BS in Computer Systems Engineering from Stanford University.

In Partnership:

Fintech Meetup is the big new Q1 event you can’t afford to miss! Powered by tech that helps you meet the right people - the right way. With 30,000+ double opt-in onsite meetings, exhibit hall, receptions, and more… 👉 Get yout ticket today for Fintech Meetup at the Aria, Las Vegas from March 19-22

Timestamps:

1’25”: Early experiences and career start

4’33”: Tech-natives with finance skills versus finance-natives with tech skills

7’07”: How to deal in a melting pot of professionals with differing skillsets

9’11”: Intro to Upstart (a pure play digital lender) and the early days of its formation

14’49”: Breaking down an AI-driven growth model and its value to digital lending

17’15”: Estimating the value of human life and typical earning power to more accurately refine the prediction model

20’06”: What is a machine learning model and how is it used in the context of digital lending?

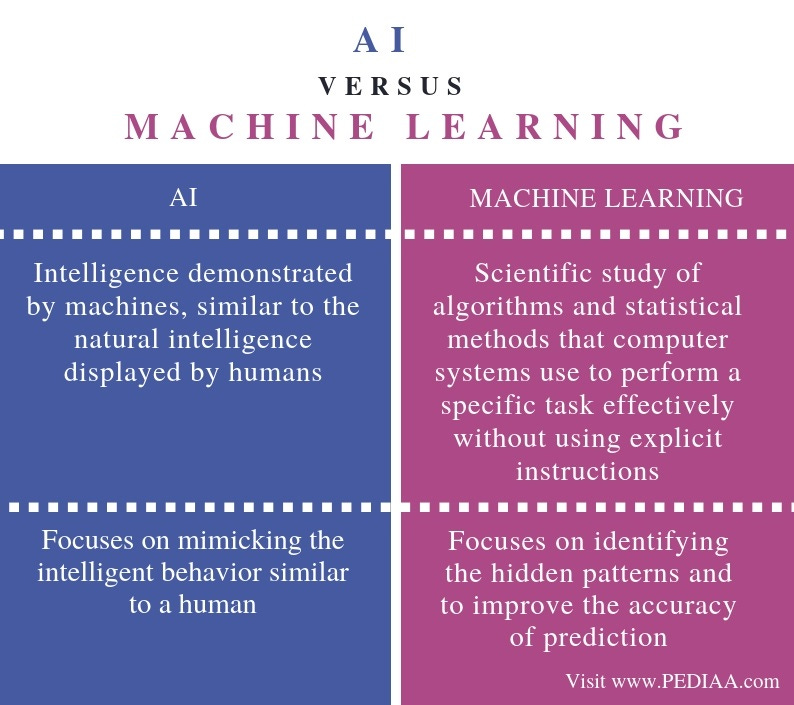

26’31”: The evolution of machine learning in financial services and how artificial intelligence is applied and evolving in FinTech

31’41”: How Upstart relates to the financial industry (banks) and what the specific benefits are

35’12”: How does Upstart figure out where to expand given its business model?

38’40”: Artificial Intelligent models: Open source public goods or intellectual property?

41’51”: Macroeconomic Environment – the impact of interest rates on digital lenders

44’59”: Channels to use to connect with Jeff and/or to learn more about Upstart

Sneak Peek:

Jeff Keltner:

…We are always testing out new versions of models, new iterations, of course, some of them increase accuracy, some of them don't. Some increase accuracy at high processing costs that's not worth it. So, we're constantly pushing the boundaries of that. But the things these models are really being asked to do, I think it's important to think about the data you're bringing in, what the model can do and what you're asking it to predict.We're bringing in, if you think about a credit file, most people look at a handful of variables coming off of a credit file. We get almost a thousand from two different bureaus. And then the question becomes, okay, I've got a thousand variables. We ask a bunch of questions on the form that people don't ask that are more available as well, over 1600 points of data on an individual application file. And then the question is, well how does one use…

If you would like to access the full transcript, subscribe below.

👑See related coverage👑

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions