Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Kareem Saleh, CEO of Fairplay — FairPlay is the first Fairness-as-a-Service™ solution for financial institutions and a fascinating company.

Kareem has been working on financial inclusion and underwriting hard-to-score borrowers his entire career. At ZestFinance (now Zest.ai) he served as Executive Vice President where he led the go-to-market strategy for the company’s AI-powered b2b SaaS underwriting platform and negotiated software licensing, partnership, financing and other commercial deals with Fortune 500 firms, credit bureaus and financial infrastructure providers.

Prior to Zest.ai, he served as an Executive at SoftCard, a mobile payments startup founded by AT&T, T-Mobile and Verizon that was acquired by Google. Additionally, Kareem has served in several senior roles in the Obama Administration, he helped manage the team that negotiated the Paris Climate Agreement, and oversaw $3B in annual investments into development-friendly projects in emerging markets.

Kareem is a Forbes contributor and a frequent speaker on the application of artificial intelligence to financial services, including consumer loan underwriting, loan servicing, model risk management and fair lending analysis. He is a graduate of Georgetown University Law Center and an honors graduate of the University of Chicago, and is fluent in French and Arabic.

In Partnership:

Get Ready to Be Blown Away! There’s a New Fintech Event in Town!

Created by the founders of Money20/20 and Shoptalk, Fintech Meetup is bringing an amazing speaker lineup, 200+ sponsors, and 3,000 attendees to the Aria in Las Vegas on March 19-22, 2023. And, our proprietary tech will facilitate 30,000+ in-person meetings!

👉 This is a great event! — learn more at Fintech Meetup or download the brochure.

Timestamp

1’25”: The core experiences that started Kareem’s career

8’26”: The legal and policy side of Kareem’s experience

12’26”: The purpose of financial inclusion and the role of private capital

15’38”: Kareem’s early exposure to artificial intelligence and the early learnings in underwriting at Zest.ai (machine learning credit underwriting company)

19’56”: How to make an underwriting A.I. algorithm outperform

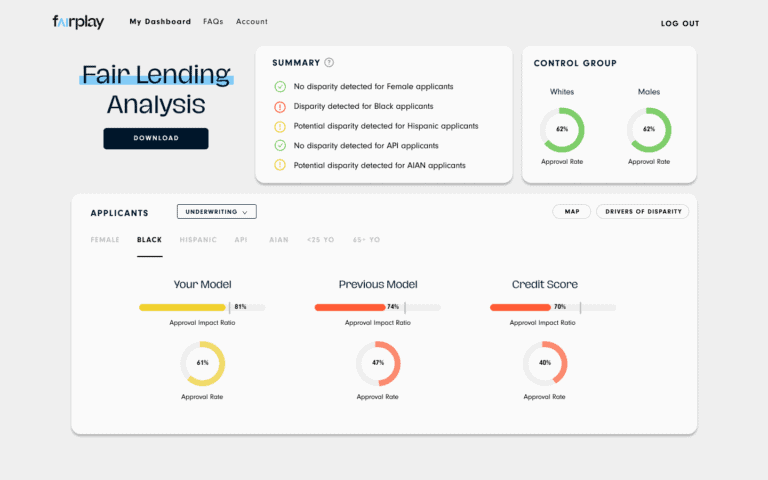

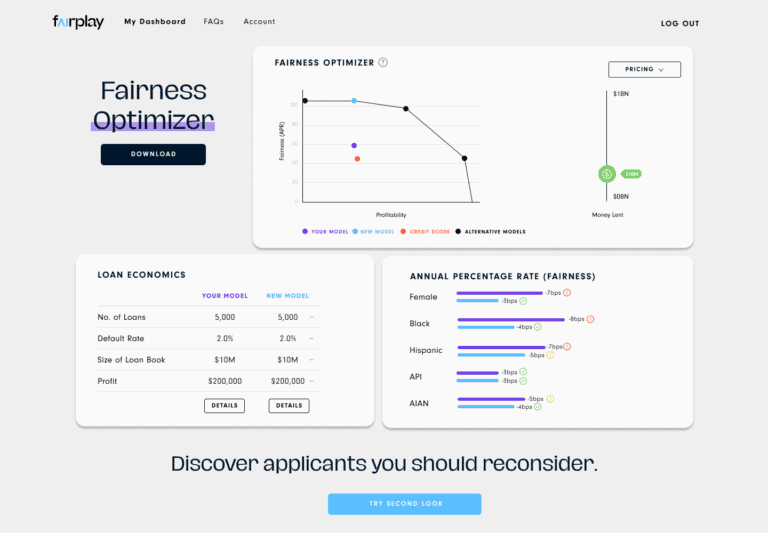

26’35”: Introduction to Fairplay (fairness-as-a-service company)

28’42”: The tech stack of Fairplay and how it connects to financial institutions

32’03”: The unique selling points and benefits of Fairplay

34’21”: The future objectives of Fairplay and public sector algorithms

40’32”: Methods to connect with Kareem & to learn more about Fairplay

Sneak Peek:

Kareem Saleh:

…so, Tesla very cleverly faces this problem in self-driving cars. If Tesla gave its self-driving cars the mere objective of getting a passenger from point A to point B, the self-driving car might do that while driving the wrong way down a one-way street or while speeding through red lights or causing mayhem to passengers or pedestrians. And so, Tesla has to give its self-driving cars or give the neural networks that power self-driving cars two targets, get the passenger from point A to point B while also respecting the rules of the road. It's a compound objective.And so, we took one look at that and asked, well, why can't we do that in financial services? Why can't we give a credit model, not only the target of predicting who is going to default, but predicting who is going to default while also minimizing disparities between protected and control groups. And so, our customers have had the benefit of using a modified loss function that has two targets in that way. And the results have been really astounding. I mean, one of the customers who uses our fairness-as-a-service solution was recently able to increase its overall loan approval rate by 10% and increase its approval rate for black applicants specifically by 16%. That yielded them an additional $130 million worth of credit originated and something like an additional $5 million in profit. So, the thing that we are most excited about on the math side are…

To read the full transcript, subscribe below:

Postscript.

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!