Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

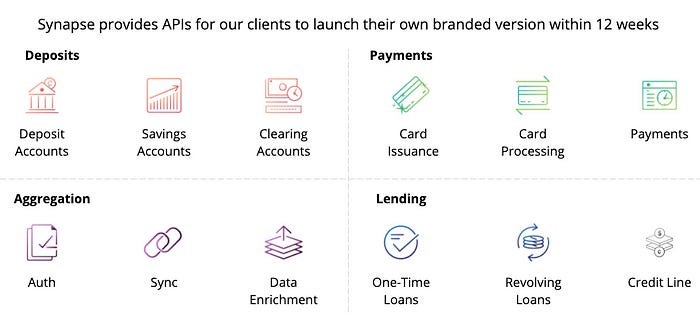

In this conversation, we chat with Sankaet Pathak - founder and CEO of Synapse, the largest regulated banking-as-a-service platform that provides payment, card issuance, deposit, lending, compliance, credit and investment products as APIs to more than 18 million end users.

After having emigrated from India to study Computer Engineering, Mathematical Sciences, and Physics at the University of Memphis. His experience of not being able to open a bank account due to his immigrant status, prompted him to launch a financial services company that could reduce barriers to entry for underbanked or unbanked individuals. Through his efforts, Sankaet found that the true barrier to entry was an outdated infrastructure which kept everyday folks from accessing best-in-class financial products. Today, Synapse services approximately 18 million end-users and processed over $76 billion in transactions in 2022. Many of Synapse's clients are early to late stage FinTech companies offering innovative financial solutions that are both accessible and affordable for end users.

Topics: BaaS, API, Open Banking, payments, banking, Fintech, Embedded Finance

Tags: Synapse, SynapseFi, Stripe, Square

👑See related coverage👑

Fintech: Inflection AI raises $1.3B from Microsoft and Nvidia, while ChatGPT traffic drops 10%

[PREMIUM]: Long Take: The evolution of embedded finance to $7T in flows, and the OCC's mandate to derisk it

[PREMIUM]: Long Take: FDIC consent order vs. $3B banking-as-a-service champion Cross River Bank

Timestamp

1’21”: Journey into fintech: Understanding the founder's background, skills, and motivation for building a banking infrastructure company

5’45”: From consumer play to financial infrastructure: The decision to build a foundational layer in the fintech landscape

10’31”: Dissecting financial infrastructure: The value of modular architecture and the challenges of integrating traditional banking services

15’45”: Envisioning the role of middleware: Banks as distribution mechanisms through third-party applications

20’52”: Examining the global demand for the dollar in crypto markets: Reflecting on the US role and implications for crypto companies

25’55”: Evaluating Synapse's scale and success: Key metrics for progress and growth

28’02”: Balancing Synapse’s business economics: Revenue generation, cost alignment, and pricing strategies in the FinTech space

31’30”: Analyzing market dynamics: Impact of COVID, growing demand, competitive landscape, and future outlook in embedded finance

37’37”: Navigating the regulatory landscape: Addressing challenges and fostering stability in a transforming financial industry

41’39”: The channels used to connect with Sanket & learn more about Synapse

Sneak Peek:

Sankaet Pathak:

…it was the winter of 2014. At that point, I had built Synapse Buyer and Seller, which were two apps... By the way, I was a customer of my own API, so I had all of this as an API. Then I was just building quite a few different experiences, mobile apps on top of it. So, I had an app called Synapse Buyer, and I have an app called Synapse Seller. Seller would let any restaurant, or any merchant just use our small turnkey POS to be able to serve a customer. We were pitching this as an alternative to Visa and Mastercard and a way to kind of eliminate interchange fees to restaurants in Memphis. We had 100 plus restaurants, and I think we had 50 plus restaurants in a wait list.Then I had an app called Synapse Buyer. This came from the location proximity hackathon thing that I was building. It would show you by proximity which merchant is close to you, and you can go and check in to that merchant and shop and rewards and over time build points, etc. We had really strong adoption on the merchant side. We had very weak adoption on the consumer side because in this market, people were, by and large, only. Restaurants are an impulse purchase. You're not pre-funding an account and then going to a restaurant. We weren't getting that much adoption on that piece of the application.

Then I had another app which was just called Synapse, which was just this peer-to-peer app. You could just search for anybody and send them money. You could search for anybody and request money from them. That app, one of my co-founders, Brian, we showed to his dad who was a dentist. We showed the app to him. He thought that dentists would really benefit from the app, and he wanted us to come with him to New York for a dental conference. So, Brian and I went to the dental conference.We weren't able to convince as many dentists, but there were a couple of software companies that were building appointment management, patient management systems. When we got to talking to them, they asked us, "Hey, we'd love to have a store-value and an easy way to do bank-to-bank payments. Could we use your product as an API?" Over the course of next couple days during that conference, Brian and I decided that Buyer adoption was limited, and instead of building this peer-to-peer B2B type business with dentists and rental properties, etc., we should just give our APIs to some of these software companies and let them embed our infrastructure within those applications. Then what they're going to put in the hands of the dentists and whoever would have so much more power than just a store-value payment processing.

So, we decided by the end of that year that we were going to start winding down Synapse Buyer, Seller, and the P2P app and go full scale ahead at the API level. The markets we had identified was going to be all these…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions