Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with David Hoare, the CTO and co-founder of Codat - a universal API platform that connects small businesses to banks and other financial platforms. Dave has proven to be an expert in the fields of digitally native platform businesses through his background. Having previously worked as a software engineer at Kriya (formerly MarketFinance) from 2015 to 2017. Kriya was the UK’s first online-only invoice finance provider. It’s grown to become one of the largest invoice finance providers in Europe, having now funded billions of pounds worth of invoices. Additionally, Dave worked as a software engineer at digital publishing company Archant from 2012 to 2014. Dave holds a Bachelor of Arts in Computer Science from the University of Cambridge.

👑See related coverage👑

Timestamp

1’26”: Codat - what the company is, how long it has been around, some of the things it does, and how small Fintechs use Codat

9’20”: The different software packages that the data aggregation adds value to, and the types of API integrations needed for the data pull

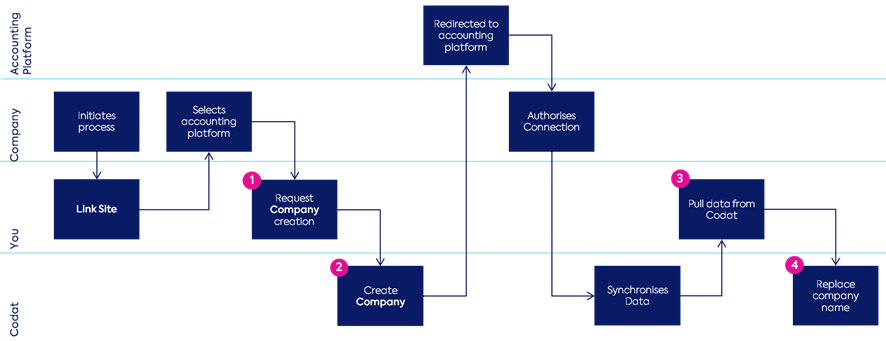

17’07”: Envisioning the customer experience and breaking down the economics of the platform

20’22”: Breaking down the requirements involved in integrating Codat into their stack, and expanding on Codat’s partnership program with large enterprises

26’43”: Examples of failed hypotheses and customer relationships, and surprisingly successful use case examples

33’42”: The current competitive landscape and dynamics evolving towards the future

37’10”: The channels used to connect with David & learn more about Codat

Sneak Peek:

Dave Hoare:

…we've been around since 2017, so three of those years have been post pandemic or during the pandemic and actually 2020 was a huge year for us. That was the year that we raised our first institutional investment. We raised our series A in May of 2020, and the catalyst for that was at the start of the pandemic, which obviously hugely unexpected turn of events, actually we got to a place where there were millions of businesses in the UK and around the world who were in desperate need of funding. And so, there were government backed schemes to assist them. Talking about here in the UK we had the CBILS scheme, we had the bounce back schemes, these are underwritten by the government, but crucially they were delivered by the banks, they were delivered by lenders and that the government in the background was underwriting those and was, I guess, backing those.And so, then we suddenly had this case where these enterprises, and we talked about how these can be very, very long sales processes, we're talking months, potentially years to be getting some of this tech into those banks. Actually, suddenly the banks have been told by the government, "Hey, you need to be in a position where you can lend billions out to small businesses and you need to be in that position in a week from now, two weeks from now." And so that proposition to a bank, certainly thinking about traditional ways in which they work, sort of unthinkable. If you think about the manual data collection and manual processing that is needed in order to do that, it wasn't going to happen. And so that was a great opportunity for us to unexpectedly play a part in that emergency response. So, we worked with some of the very, very largest banks here in the UK to help them stand up lightweight application journeys that rather than depending on the manual data collection and depending on those traditional ways of working, actually had automated data collection front and center.

So actually, it's a much quicker experience for the business who is in this dire financial situation and is in desperate need of funding. And then that automation allowed the bank to…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions