Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, our Editor-in-chief Lex Sokolin walks through how 2023 is the year for executing on raw fundamentals, which means understanding how to design a Fintech or DeFi business model and understanding the shape of demand. Companies must focus on customer centricity and use a Lean Startup methodology to validate ideas and assumptions. This is done by testing products and services with prospects, using digital landing pages, and buying Google Ads to drive people to those landing pages.

In Partnership

Fintech Meetup: Fintech's Only BIG Q1 Event! We’ve built a whole new tech enabled event experience, and we think you’re gonna love it. Meet with anyone for any reason using our incredible tech-powered meetings program that connects 3,000+ attendees to 30,000+ double opt-in meetings. Plus 200+ sponsors, 250+ speakers, exhibit hall, and more! At the Aria, Las Vegas March 19-22.

👑See related coverage👑

Blueprint: $200MM for Asian Fintech Akulaku; China’s digital asset marketplace; Lido leads in TVL

[PREMIUM ACCESS]: Long Take: How to design your Fintech business model (Build It Series, Part 1)

Timestamp

0’31”: Introduction - What the last 3 years brought to the Fintech space

2’45”: How to approach 2023 from a mental model perspective

7’03”: The approach to designing a Fintech or DeFi business model in 2023

16’27”: The Lean Start-up Methodology & how it optimises product market fit

22’48”: Methods to seeking economically sufficient demand: traditional banking vs neobanking models

27’45”: Automation of the CFO stack vs Decentralized Autonomous Organizations (DAOs)

30’48”: Risk appetite: Betterment vs Coinbase vs MetaMask - their similarities and vastly dissimilar approaches to win consumers

36’11”: Economic models attached to opportunities

44’32”: Platform businesses providing an intermediating layer with repeatable demand

46’29”: The nature of economic flows: Money in motion vs money at rest

50’49”: Conclusion - closing remarks

Sneak Peek:

Lex Sokolin:

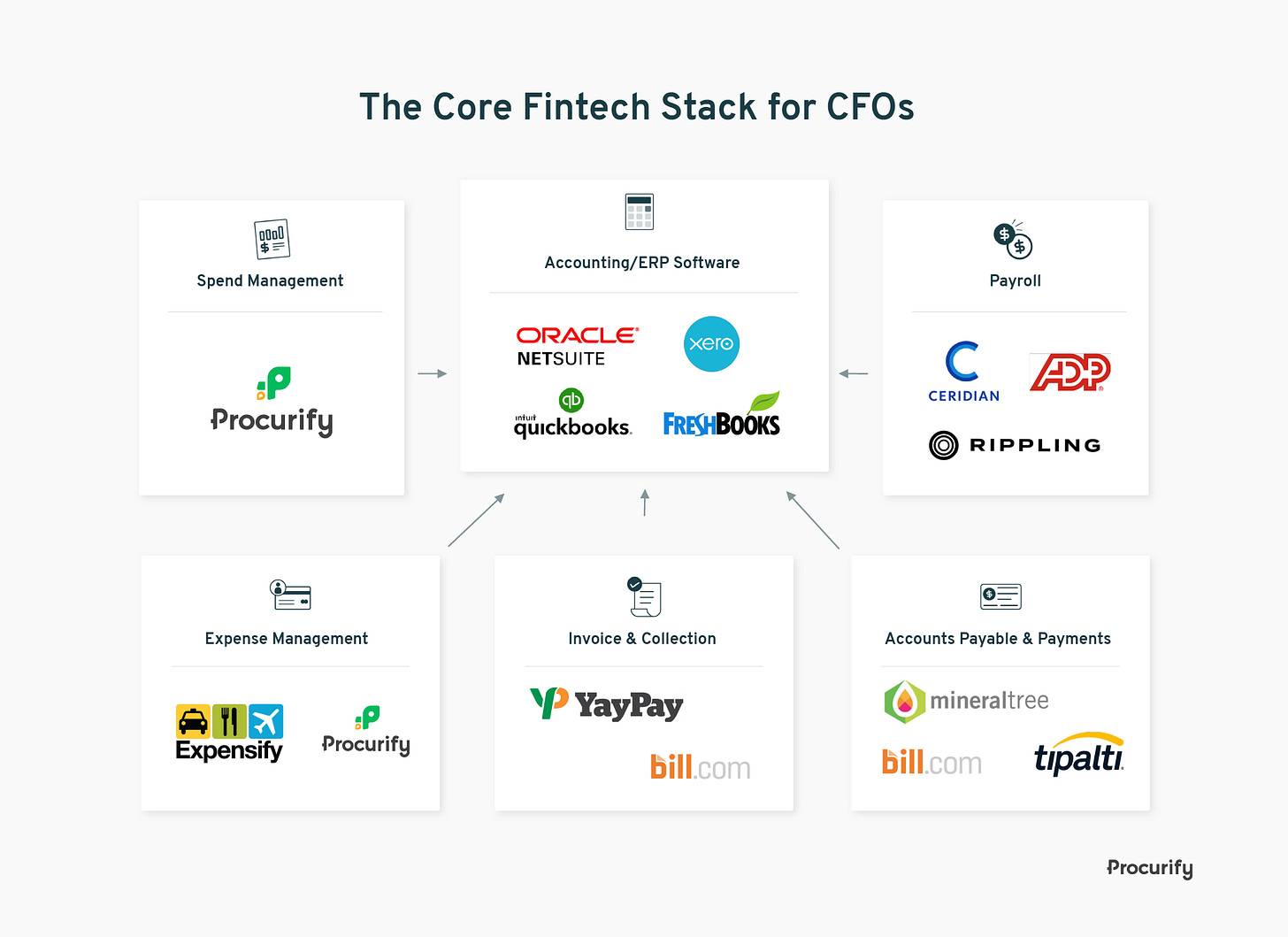

…another approach is to look at demand through the lens of novelty, not through. These are repeatable patterns, and we know where they are and we know how many mortgages people need to do per year and so on. But instead to look at the platform shifts, the transitions, the weird things that are going on where demand is uncertain. What is the demand for iPhones going to be? What is the demand for ads technology and so on? So, you look at places where you have uncertainty and you have open frontiers. You would call these blue ocean opportunities instead of red ocean, which have lots of competition. Blue ocean is open, nobody's there yet. So, I gave the example of the iPhone. Another toy example would be cases for iPhones or iPhone protectors. The first iPhone comes out and you go, ah, I'm going to go after this opportunity to create print your own case protectors for iPhones.Maybe that device will be popular, maybe it won't. You don't know. You don't know how much it will grow. So that bet is very uncertain in terms of its exposure, but it has asymmetric upside. So, if we look at things that are similar in fintech and in DeFi, I'll give you an example. So, one of the transitions has been the automation of the CFO technology stack. So, the chief financial officer at a company uses likely spreadsheets and all sorts of reconciliation systems. So fintech has built out a whole bunch of payment operations, payroll processing, and other integrated systems to help the CFO function of businesses. And in many ways, small businesses do these things in a much more integrated automated customer-centric ways. Now, the same thing is happening to decentralized autonomous organizations in Web3. DAOs. So DAOs are like small businesses except they are in this internet digital world, and they also have payroll.

DAOs have lots of people who are doing stuff and want to be paid in tokens, so they need automated payroll. DAOs also need to figure out…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions