Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Aron Alexander - Founder and CEO of the digital value and infrastructure provider Runa. Aron has been deeply engrossed in the commerce world since his early days spent in his family's retail and grocery stores. This interest would later expand into managing a family office and leading a division at a B2B2C payment company. However, it was an exasperating experience of trying to spend a £5 paper voucher received by mail that served as the spark for his entrepreneurial journey.

In 2016, he channelled this frustration into the foundation of WeGift. His vision for the company was to revolutionise the way digital value is disseminated and utilised by organisations, individuals, and merchants alike.

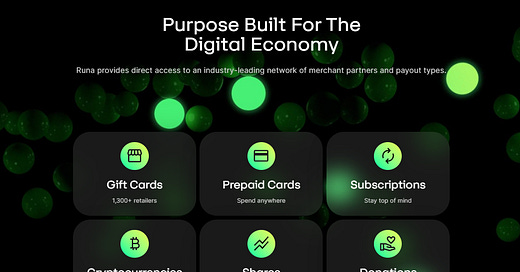

Fast forward 7 years, WeGift re-emerged as Runa, the digital value infrastructure set to fill a gap in the market. Runa represents a unified digital payments infrastructure that supports frictionless B2C, C2C, and C2B payments. By simplifying the circulation and use of digital value, Runa aims to offer a mutually beneficial solution for businesses and consumers.

Topics: payments, paytech, infrastructure, cryptocurrency, digitalization, embedded finance

Tags: Runa, WeGift, PayPal, TransferWise, CoinBase, Twilio

👑See related coverage👑

Fintech: AngelList expands into private equity with acquisition of fintech startup Nova

[PREMIUM]: Deep Dive: Can Klarna, the BNPL category creator, rise to its market challenge?

[PREMIUM]: Long Take: Why is FIS spinning out Worldpay after 4 years and a $17B writedown?

Timestamp

1’19”: Unveiling the founding story: How commerce insights led to startup ideation

7’36”: Understanding the role of payment networks and loyalty programs: Aligning incentives for merchants and providers

12’34”: Introducing Runa: Integration, impact, and numbers in simplifying payments for merchants

17’52”: Decoding the industry structure of third-party gift card providers: Concentration, diversity, and geographic impact

20’16”: Building a global API layer: Navigating the choice of wide coverage vs. deep focus

24’20”: Mechanisms of cross-border money movement: Understanding infrastructure, risk, and partnerships

27’16”: Handling international transactions and scale: Bank accounts, volumes, and consumer impact

30’17”: Exploring the best customer use case: An embedded finance layer for business-to-consumer payouts

33’01”: Understanding the growth strategy and revenue model: Structuring incentives for success

36’14”: Exploring alternative forms of value: Role of equity shares, cryptocurrencies, and NFTs in the business

39’13”: Embracing alternative assets: Mitigating volatility and facilitating seamless transactions

40’59”: The channels used to connect with Aron & learn more about Runa

Sneak Peek:

Aron Alexander:

…that's a great question because I think again, it unearths the kind of payments landscape and in retail. Effectively, a merchant needs to recognize a payment type and have it accepted by its system. And we do that in a number of different ways. We first started building this network through closed loop store value systems, i.e., gift cards. So, we integrated into a merchant's gift card system because that was the cheapest, quickest way for the merchant to recognize us as a payment type is by using their own currency. Getting integrated into a merchant alongside the likes of Visa, MasterCard is a very difficult and different proposition. You kind of need scale from day one to convince a merchant to use you as a payment type and you need a business case. So, for us it was, well, we can drive corporate spend to your stores and we can do it in a really simple light touch way.When we integrate into the likes of First Data, or Vantiv, or Givex, whichever payments or loyalty or EPOS system that the merchant has, we'll get a connection to. And then when the consumer arrives at the merchant, they simply select the merchant, enter the amount, and then we spin up a code that can be redeemed at that merchant. And that code happens to be something the merchant recognizes, which is their own gift card to start with. We're now integrating into point-of-sale system, so we're more like a pay with Runa at checkout, same with online, integrating into the checkout flow so that. You can pay with PayPal, pay with Klarna, pay with Runa, and that's the evolution of our merchant network. But we've found a very cheap, quick way of doing it, through typically…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions