Hi Fintech Futurists,

Welcome back to our podcast series!

In this conversation, we talk with Anne Boden, the CEO of Starling Bank. Starling has just turned profitable, and reached several significant milestones in terms of 1.8 million clients, $4 billion in deposits, and $1.5 billion of lending.

That is quite meaningfully ahead of our model, and probably ahead of everyone’s model, of where neobanks would be in 2020. While COVID has accelerated the digital lifestyle, Anne credits deeper demographic, technology, and cultural insights and choices she has made in building Starling for success.

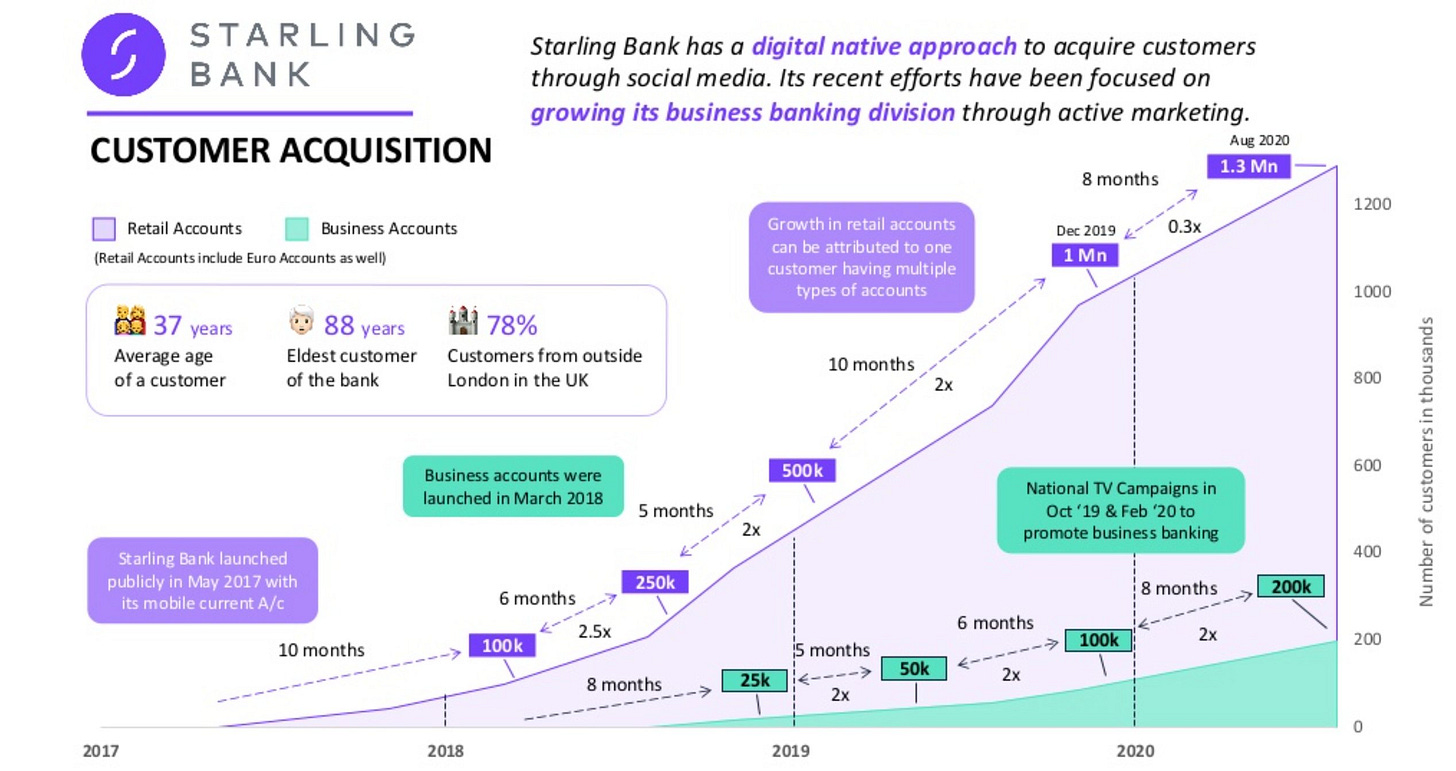

The visualization above tells a strong story, sourced from Whitesight. Raising $470 million is fuel for the growth. We enjoyed our conversation with Anne, and got a view of her focus beyond the machinery of the economics.

For premium subscribers, an full transcript is provided along with the recording.

Hope you enjoy, and do not hesitate to reach out here!

Excerpt

Anne Boden:

Yeah, I think it's very important. We haven't had to manufacture a culture at Starling. Now, one for something, we're a very diverse organization. We really, really feel for customers when they're having a hard time. And I hope that we will never be a cold organization. We believe that the most important thing your life is your health and then your family's health, but then it's your financial health. We feel for that, we feel for people that are going through difficult times and especially in this crisis. So, we believe that you can feel the culture, you can touch the culture at Starling. And the important thing is that people like working for an organization that they can identify with. And some of those things you cannot manufacture you either are, or you're not an organization that has values and has a mission.

I think that Starling always considers deep markets. We don't want to be niche. We want to grow in markets that are big. We have no intention of doing insurance and asset management products. We will always provide those to a marketplace in the UK. We have every intention of becoming one of the big five players in the UK in retail banking and across Europe, we're applying for a banking license in Ireland and we'll use that to passport into European countries. So we've got quite a lot on our plate. And it's very exciting.

For the annotated transcript and additional premium analysis, subscribe here: