Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with William (Bill) Capuzzi, CEO at Apex Fintech Solutions. In his role as Chief Executive Officer at Apex Fintech Solutions, Bill sets the vision and strategy to help Apex identify and realize new areas of growth and opportunity. Prior to his role as CEO of Apex, Bill worked at Convergex Group where he was Chief of Staff and a member of the firm’s Executive Committee. Bill also served as Director at Pershing LLC, responsible for their institutional product suite and directed their global re-engineering efforts firm wide.

Bill was elected to the DTCC Board of Directors in March 2022 and is also a current board member of TraderTools, Apex Fintech Solutions Inc., and Apex Clearing Corporation. Additionally, Bill is an EY Entrepreneur Of The Year 2021 Southwest Award Winner. Bill earned a Bachelor of Arts degree from Wesleyan University in Connecticut and a Master of Business Administration in Strategic Management from Rutgers University.

In Partnership

Fintech Meetup: Ticket Prices Increase Tonight at Midnight! This is Q1’s BIG new event with 250+ speakers, 200+ sponsors, an exhibit hall & a tech-powered meetings program (30,000+ double opt-in meetings!). We deliver real results and measurable ROI. At the Aria, Las Vegas March 19-22.

👑See related coverage👑

[PREMIUM ANALYSIS]: Long Take: Creating a B2C fintech marketing strategy (Build It Series, Part 2)

Digital Wealth: Impact of Betterment's new $48/year minimum fee

Timestamp

1’50”: A breakdown of Bill’s foundational experiences

13’37”: Definitional breakdowns of custody, clearing, and settlement

19’19”: Unbundling custody solutions from broker-dealers and retail distribution, and the regulatory implications

27’04: The dynamic between digital wealth management platforms and either robo-advisors or traditional advisors using robo platforms that plug into their custody

31’07”: Joining Apex in 2010 - the customer profiles, tech stack, opportunities, and vision to where Apex is today

33’31”: Hyper efficiency - offering zero commission and fractional shares in 2015/16

36’52”: The current winning formula for B2C tech-enabled financial companies that Apex supports

40’27”: Channels to use to connect with Bill & learn more about Apex Fintech Solutions

Sneak Peek:

Bill Capuzzi:

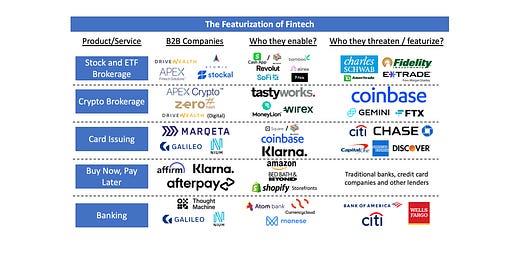

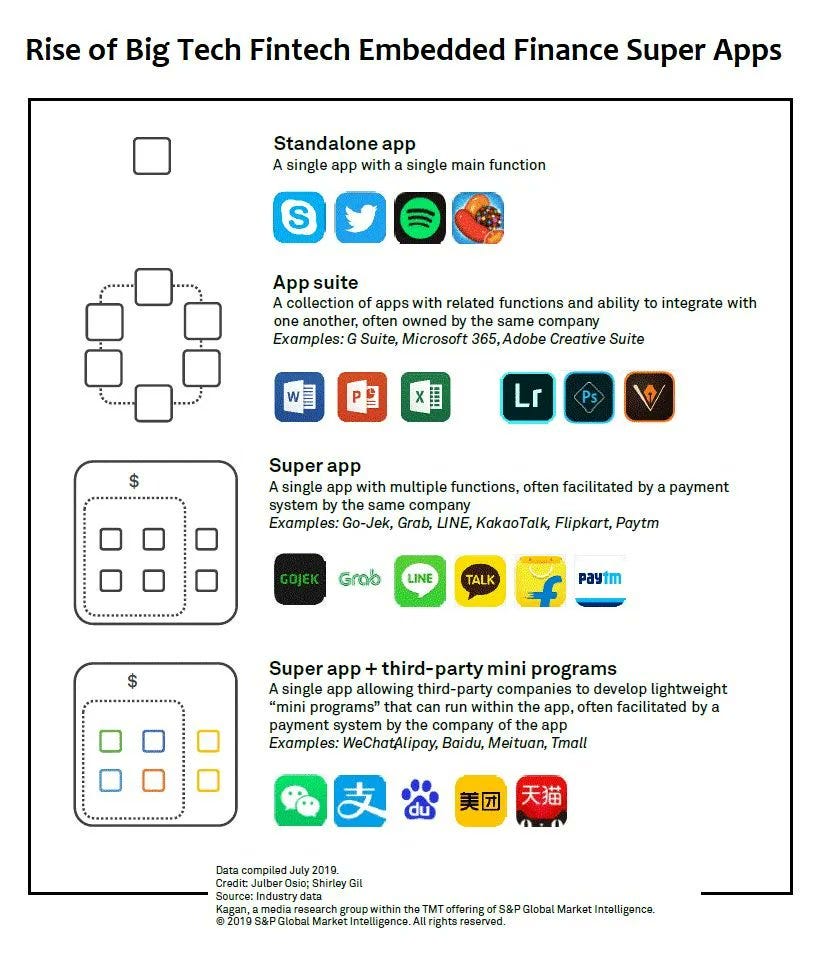

…there's kind of two dimensions of convergence. One, within FinTech, the convergence between banking and investing, investing and lending, we're seeing sort of this advent of super app. So, you have that on one side and then you have sort of traditional advisory, which by the way is where most of the assets live today.I don't know about you, but through the pandemic, I sat at home, and I had CNBC on every day. I would watch these commercials for Schwab Intelligent Portfolios, which is sort of their robo product for the end customer. The commercial depicted this sort of goofy advisor interviewing a married couple and asking questions around how they manage the money. And the couple would respond by saying, "Here's all the cool things this Intelligent Portfolios does." And the advisor would be like, "Damn that Schwab." And I found that commercial striking because Schwab today sort of plays both sides, right? So, they have a direct-to-consumer product that's getting even bigger through the acquisition of TD, but they also support B2B, all these advisors that are sitting on their platform leveraging them as a sort of custodian where we started the conversation. And so, there's just conflict there, right?

Part of the reason the industry, at least the advisory industry, has tolerated it is because there really haven't been any good alternatives. So, if you're an advisor and you're managing a billion dollars, where are you going to go? And you're sitting in the US, you have Schwab, you have Fidelity, you have Pershing, which is purely B2B, but…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions