Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

We're excited to kick off the New Year 🎉 with a special offer for those looking to level up their fintech knowledge. Take control of 2024 with 20% off a Premium membership to The Fintech Blueprint.

In this conversation, we chat with Steve McLaughlin - CEO and founder of FT Partners, the premier financial technology investment bank, and Jon Lear - president and co-founder of Fintech Meetup, which is the leading fintech conference in the world today.

Steve started his investment banking career at Goldman Sachs covering financial technology companies in 1995. Seven years later, he left Goldman to launch FT Partners at the age of 32. He has been successfully running and growing the firm for almost 20 years and is one of the undisputable leaders in Fintech capital raising and M&A advising. McLaughlin has been recognized with multiple industry awards, including Investment Banker of the Year by The Information, and is consistently ranked as one of the most influential people in Fintech around the world. Steve holds an MBA from the Wharton School and a BSBA from Villanova University.

Jon is a seasoned finance executive who has a rich background in strategy and marketing formed at the start of his career at The Procter & Gamble Company. Subsequently, Jon joined Earthport where he played a crucial role in its growth and eventual acquisition by Visa Inc., securing partnerships with major banks and e-commerce giants. Joining JPMorgan Chase & Co. in 2017 as Global Head of Network and Partnerships, he expanded his role to include North America's FX Product and later, the Wholesale Payments Solutions Team. Known as an accomplished public speaker, Jon excels in translating complex financial concepts into practical solutions, leveraging his extensive experience in the fintech sector.

Fintech Meetup (March 3-6) is less than 60 days away! Don’t miss Fintech’s new BIG show with “the highest ROI” for attendees & sponsors. Ticket prices go up Friday 1/12 at midnight. Don’t miss out!

Topics: fintech, finance, Investment Banking, Blockchain, crypto, paytech, insurtech, infrastructure

Tags: FT Partners, Fintech Meetup, NASDAQ, ETrade, EarthPort, Visa, Mastercard, JP Morgan, Goldman Sachs, Stripe, Worldcoin, Intuit

👑See related coverage👑

Fintech: HSBC Zings into payments competition with Revolut and Wise

[PREMIUM]: Long Take: Can we be optimistic about 2Q2023 Equities, Crypto and Venture markets?

[PREMIUM]: Long Take: An obituary for Mint.com, which inspired a fintech revolution

Timestamp

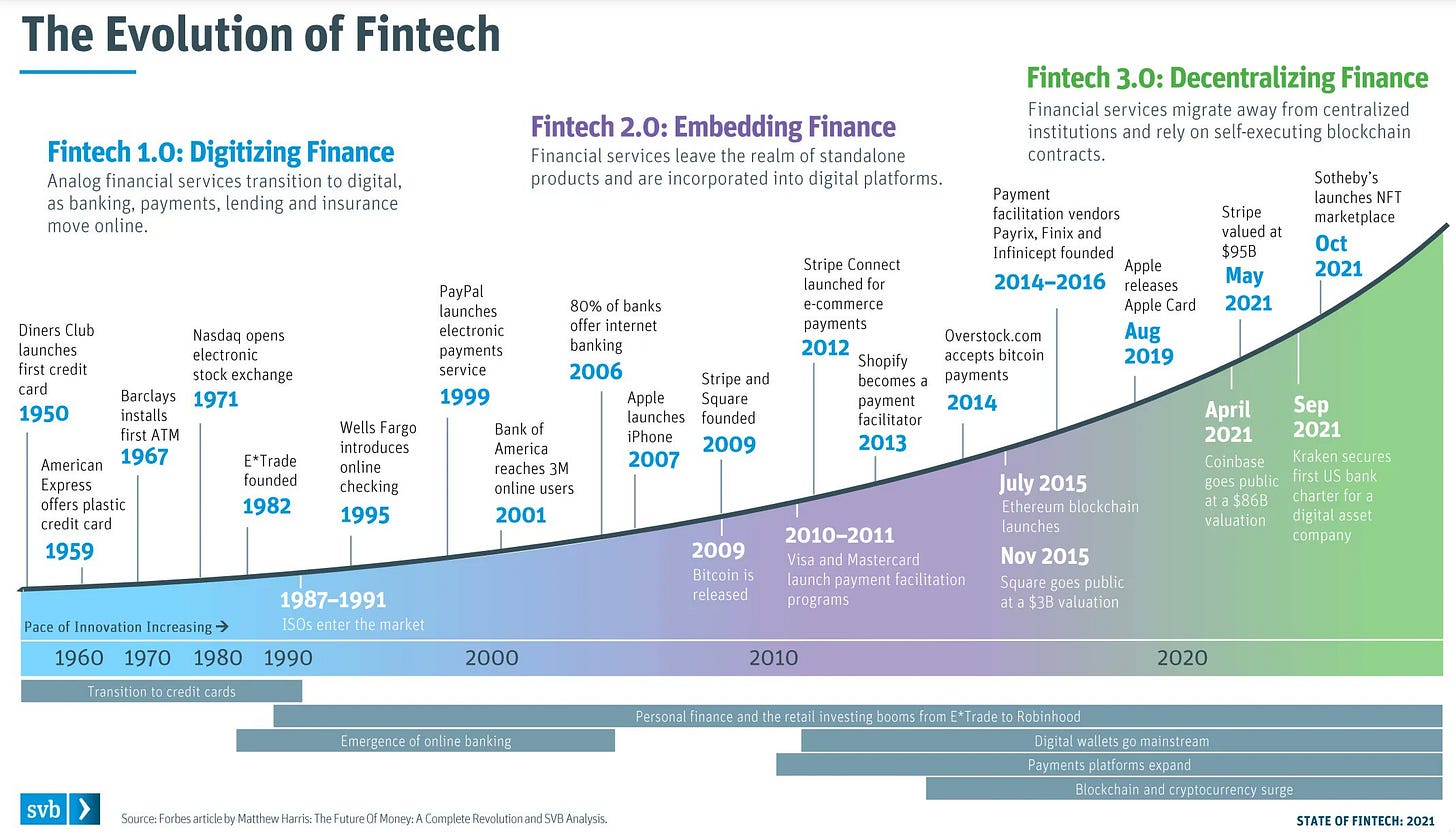

2’21: From Goldman Sachs to FT Partners: Steve McLaughlin's Journey Through the Evolution of Fintech

6’39: Digital Finance Evolution: Steve expands on the Enduring Impact of Early Fintech Companies

9’35: Traversing the Fintech Landscape: Jon Lear’s journey from Procter & Gamble to Fintech Entrepreneurship and Beyond

15’58: Repeating Patterns in Fintech: Exploring Persistent Challenges and Innovations in Financial Technology

20’59: Defining Fintech: Navigating the Blurred Lines of Financial Technology in Today's Evolving Market

28’57: Emerging Ecosystems: How New Technologies Reshape Traditional Financial Services and Create Unique Economic Spheres

32’56: Fintech in Focus: Insights from Fintech Meetup on Market Dynamics, Innovation, and the Shift Towards Infrastructure

36’22: Risk Assessment in Fintech: Evaluating Current Market Dynamics and Venture Capital Trends in the Financial Sector

40’36: Navigating Challenges in Fintech: The Complex Dynamics of M&A and Growth Strategies Amid Market Volatility

43’39: Emerging Trends in Fintech: Identifying Growth Opportunities and Innovations in Blockchain and Payments

45’38: Future Fintech Frontiers: Uncovering Growth Sectors and Geographical Opportunities in the Financial Industry

50’57: The channels used to connect with Jon & learn more about Fintech Meetup

51’10: The channels used to connect with Steve & learn more about FT Partners

Sneak Peek:

Steve McLaughlin:

…at the end of the day, JP Morgan's a big bank with a lot of big buildings and desks and branches, all this kind of stuff, but the products are all virtual. You don't see a loan on a shelf. And so, when you have things that are digital as a core product to begin with, there's really no end to the level of innovation and improvement you can have. So, while you think that there's been no improvement, there's been a lot, there's just always much more you can do. So, at any point in time, it feels like you've got all these huge problems that can be solved. I mean, at least at the moment, you and I can go to E-Trade or Schwab and trade 100 shares of Apple for $7 that used to be $150.So, there's been a lot of things that have been solved. Auto insurance, you can get a quote even at GEICO and they say 15 minutes, but it's really five. So, it's just everyone wants to take it to the next, next, next level. So that's really the reason I love fintech. It’s just people keep saying, "Oh, my god, is fintech dead because the market's down or in the second inning?" I think we're always going to be in the second innings of it, and the opportunities are massive. I mean, even if Ripple becomes a trillion-dollar company or Worldcoin becomes a trillion-dollar company someday, there's still going to be problems with moving money around the world and identity probably. So, there's always another mountain to climb, in my opinion.

Jon Lear:

Yeah, I agree with you, Steve. And using the Earthport story as well, I think we were faced with a very interesting question, Lex, which is, which market do we want to serve? Do we want to go the infrastructure routes and basically sell picks and shovels, i.e. sell to the banks, or do we want to go build an SMB or a consumer proposition? And we'd have probably got, we think, a much, much richer valuation if we'd have done the consumer side and tackled it, much like Wise did. Ultimately, we went down the infrastructure route and I think the learning for us was long-term that probably would accrete as much if not more value versus a sexy consumer-facing brand that everybody can immediately wrap their minds around. But it's going to take much, much longer. So that's where I think you've seen a player like Earthport establish themselves, really redefines the infrastructure. But when you're talking about changing infrastructure for big global banks, big money movers as opposed to launching a complete greenfield consumer proposition, you're talking about…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions