Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Eric Barbier, CEO of Triple-A a crypto payment gateway regulated by MAS, Singapore’s Central Bank. president of PayTop a French FinTech and is also on the board of stc pay, the neobank of stc, the largest mobile network in Saudi Arabia.

Eric is the founder of TransferTo (now Thunes and DT One), the global mobile payment network interconnecting financial institutions, merchants and mobile operators in Emerging Markets. Eric founded TransferTo in Singapore in 2006. TransferTo has been acquired by Ingenico, the leading payment solutions provider.

Before TransferTo, Eric co-founded Mobile 365, the global mobile messaging hub. Mobile 365 was acquired by Sybase (now SAP) in 2006. Eric holds a Master’s Degree in Information Technology

Topics: Fintech, payments, paytech, crypto, commerce, ecommerce

Tags: Triple-A, TransferTo, Thunes, Bitcoin, Ethereum, Mpesa

👑See related coverage👑

Quick note on format before we get into it. We are combining the Blueprint Short Takes and the Digital Wealth edition to create an issue focused on digital investing, banking, and payments sent out on Mondays. These sectors are going through analogous transformation, as automation digitizes existing services and replaces distribution channels. A separate email focused on DeFi and digital assets will be sent on Thursdays as started this week.

We hope this change helps you make the most of the Blueprint, and as always we welcome any feedback.

Timestamp

1’14”: TripleA: what it is, what it does, how it got started, and how it has evolved over time

4’23”: Unraveling the Crypto Payments Journey: Initial Asset Considerations, Building the Merchant Network, and Understanding the Evolution of Commerce

8’41”: Navigating the Crypto Commerce Landscape: Exploring Product Market Fit, Go-to-Market Strategies, and the Impact of Geographical and Market Volatility on Adoption

13’59”: The Blueprint of Crypto Payments: Exploring Infrastructure, Risk Management, and Liquidity in Digital Asset Transactions

18’16”: Mitigating Risks in Crypto Commerce: Unveiling the Importance of Banking Relationships, Enhanced Due Diligence, and Robust Compliance Frameworks in Last-Mile Settlements

22’16”: Exploring the Penetration of Crypto in Broad-Scale Commerce: Visualizing Expansion Strategies and Assessing Potential Limitations in Market Availability

24’28”: Tracing the Entrepreneurial Journey: Insights from Thunes and the Shift from Telecommunications to Value Transfer Networks

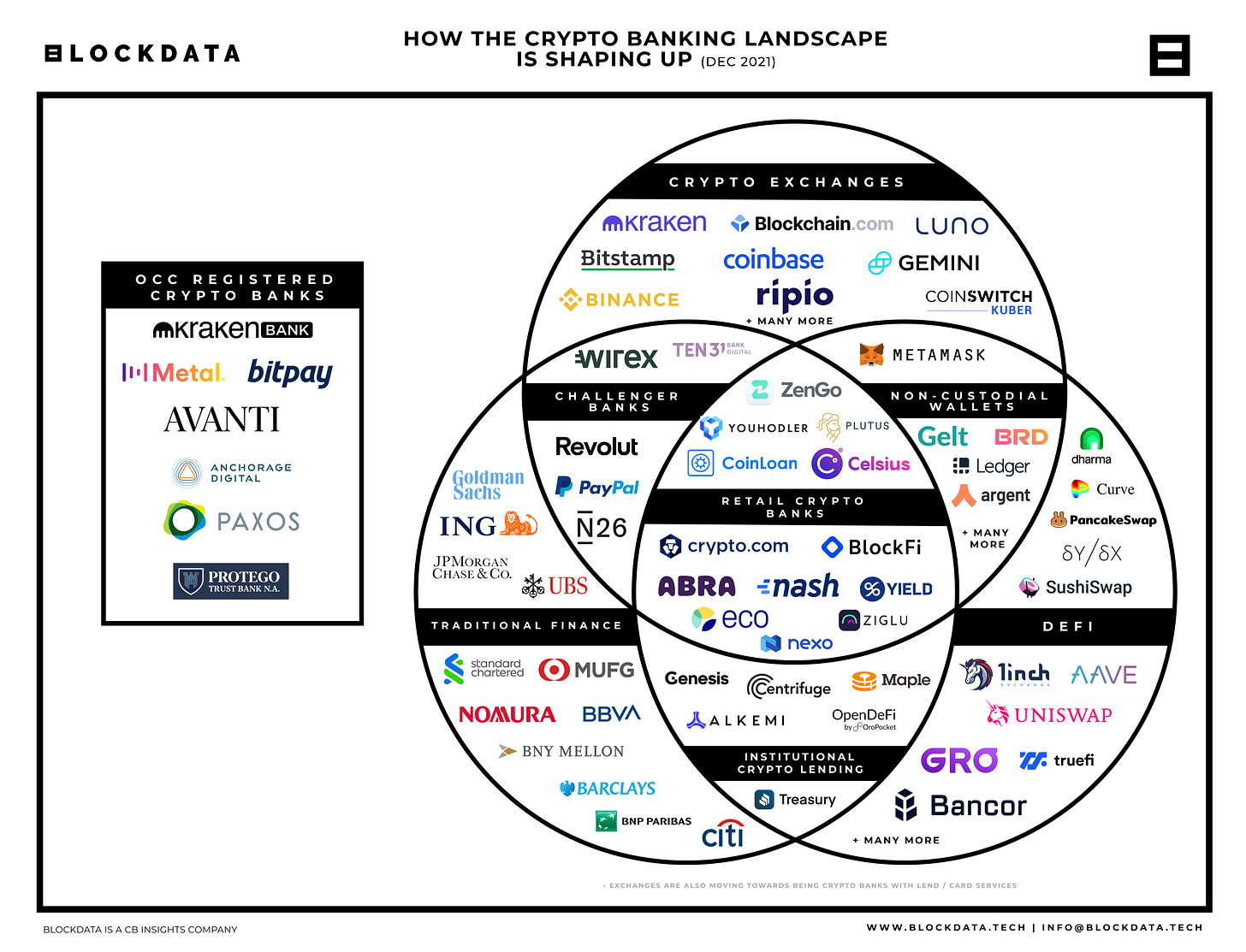

30’03”: The Confluence of Different Players in Creating Value Networks: Reflecting on the Roles of Telcos, Banks, Card Networks, and Tech Firms in Money Movement Evolution

32’25”: Leveraging Market Demands in the Evolution of Payment Systems: A Comparative Analysis of Thunes and TripleA's Approaches to Cross-Border Payments

34’51”: The channels used to connect with Eric & learn more about TripleA

Sneak Peek:

Eric Barbier:

…you alluded to banks is one of the most complex and where we have the biggest risk for the business because obviously we need to have, we're relying on the banks to do the actual last mile settlement and so that's why the fact that we are regulated, we have a very strong compliance program has been helpful in convincing banks and other financial institutions to work with them. But it's obvious that each time we work with a new bank, we have to go through an enhanced due diligence and they're really going deep into how we handle the KYC, how do we make sure that the crypto originating from dark web or scam or even worse, which can be connected to OFAC listed sanction, how do we deal with that? How do we make sure all this activity is being stopped, flagged, reported to the authority? And so, we have very strong and comprehensive compliance framework to deal with that.Lex Sokolin:

Do you use third party providers to do those, your transaction checks? And then is that difficult to do across multiple chains?Eric Barbier:

We're using different vendors. We're using Elliptic and Scorechain because one of the challenges in our case, and that's why it took us a while to find the right vendors, is that we need to have real-time information, a real-time result when in an e-commerce transaction. So, you can't ask the user to wait and wait in front of the screen for this to happen. That's why the tools which we're using have to be able to provide us with real-time information.There's always a lot of fine tuning on those tools. Those tools are great, but they are not always perfect. To give you an example, there was a lot of complexity when OFAC put Tornadocash on their list, that created a lot of issues and those tools took a bit of a while to adjust to that, making sure that if a transaction happened before it was listed, we should still have a go, and so on. Because treating with OFAC is really specific, because you probably need to freeze the assets and so on. There's this other type of money laundering risk. It's very important to have…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions