Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

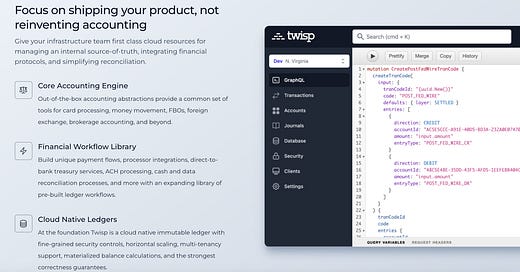

In this conversation, we chat with Jarred Ward, CEO and co-founder of Twisp. Ward has been tasked with building nearly every part of the modern financial ecosystem, from a greenfield core banking stack, direct integrations with Visa and the card networks for card issuing, and later, building a banking-as-a-service API on top of BBVA’s global core. The transition to BBVA was as a result of being principal engineer at Simple, the first neobank, which was acquired by BBVA.

Over a 12 year span, he built, operated, and scaled dozens of ledger systems with at times more than 100 engineers. Looking back, one thing is certain: ledgers are classic undifferentiated heavy lifting, but extremely difficult to implement correctly.

In Partnership

Note: This episode was sponsored by Twisp. We are committed to highlighting partnerships transparently, and only work with organizations that we find compelling from an editorial perspective.

Attend Q1’s Big New Fintech Event and Start 2023 off Strong! Join 3,000+ attendees and 200+ sponsors from across the entire fintech ecosystem for incredible networking, informative content, and a tech-powered meetings program that’ll facilitate 30,000+ double opt-in meetings. Find new leads, deals, and partnerships at the Q1 event you can’t afford to miss! At the Aria, Las Vegas March 19-22.

👑See related coverage👑

[PREMIUM ANALYSIS]: Long Take: Should Plaid launch a payments network on Arbitrum?

Digital Wealth: Apex & Unifimoney offer roboadvisory and asset custody to banks

Timestamp

1’29”: The foundational experiences in Jarred’s education and career

3’39”: Identifying the ways in which computers and automation were helping people in finance solve their problems

7’35”: Jarred’s experience working at B2C consumer neobank Simple and its approach to success in a highly competitive space

12’58”: The approach of the financial stack in a US-based traditional bank vs. neobank like Simple

16’47”: The acquisition of Simple by BBVA and their approach to remaining competitive and relevant

22’29”: The evolution of banking: Is old infrastructure with a modern API-based real-time infrastructure on top the answer?

25’32”: Twisp – financial ledger infrastructure: Founding the company and its core propositions to date

33’08”: The fundamentals of a core ledger and how abstraction supports assets of differing types

38’39”: The ways that modern stacks are able to get around the natural limitations of technologies like MySQL and Postgres

43’52”: Financial workflows: Their evolution, customer adoption preferences, and the ability to package them into on-demand financial infrastructure

46’50”: Channels to use to connect with Jarred & learn more about Twisp

Sneak Peek:

Jarred Ward:

An interesting thing is, we've seen some unexpected use cases. In hindsight, I don't think they should have been unexpected, but they were for us. One of the first ones was around brokerage systems. What does it look like to keep track of securities, and options, and buying some of these things on the open market, and all of the accounting that occurs inside of that? Those are very complex accounting systems where you have trades that are open, trades are settling, trades are closing, they might not open, they might not close.There's this process of, "How do I keep track of these massive amounts of data?" I think that has been one interesting use case that took me by surprise is, folks coming in and saying, "Hey, I have this problem. It's not actually currency, it's not US dollars, or Euros, or whatever, but it's actually a security." These concepts of a ledger really applied to helping them solve this problem. So, I think that's been an interesting thing for me, is starting to see, people are interested in the correctness of these underlying systems.

They're interested in getting it right, they're interested in having that financial observability, and they're interested in tools that can scale as well. That's been one other thing that's been interesting to me. There are some organizations that have massive scale core ledger systems. They start to hit performance issues, "Maybe we're running on MySQL and now we're thinking about building charted clusters," these complex engineering problems. When we think about Twisp as a solution, if you can come in with…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions