Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Will Beeson, who currently works at Standard Chartered Ventures. Previously, Will was the Co-Founder & Chief Product Officer at digital bank BELLA, as well as, a Principal at Rebank, a fintech advisory firm. Will’s banking entrepreneurship streak doesn’t end there, he co-founded Allica, a digital bank for businesses in the UK. After starting his career at Citigroup in New York, Will spent nearly a decade in Europe working with and managing financial services companies prior to launching Allica. Will holds a BA from Amherst College (USA) and is a Chartered Financial Analyst (CFA) Charterholder.

In Partnership

Fintech Meetup: The Next Big Q1 Fintech Event! We’ve built a whole new tech enabled event experience, and we think you’re gonna love it. Meet with anyone for any reason using our incredible tech-powered meetings program that connects 3,000+ attendees to 30,000+ double opt-in meetings. Plus 200+ sponsors, 250+ speakers, exhibit hall, and more. At the Aria, Las Vegas March 19-22.

👑See related coverage👑

[PREMIUM ANALYSIS]: Long Take: What's wrong with $12B Credit Suisse, but right with $8B Wise

Digital Wealth: J.P. Morgan invests in Swiss wealthtechs Edgelab and Evooq

Timestamp

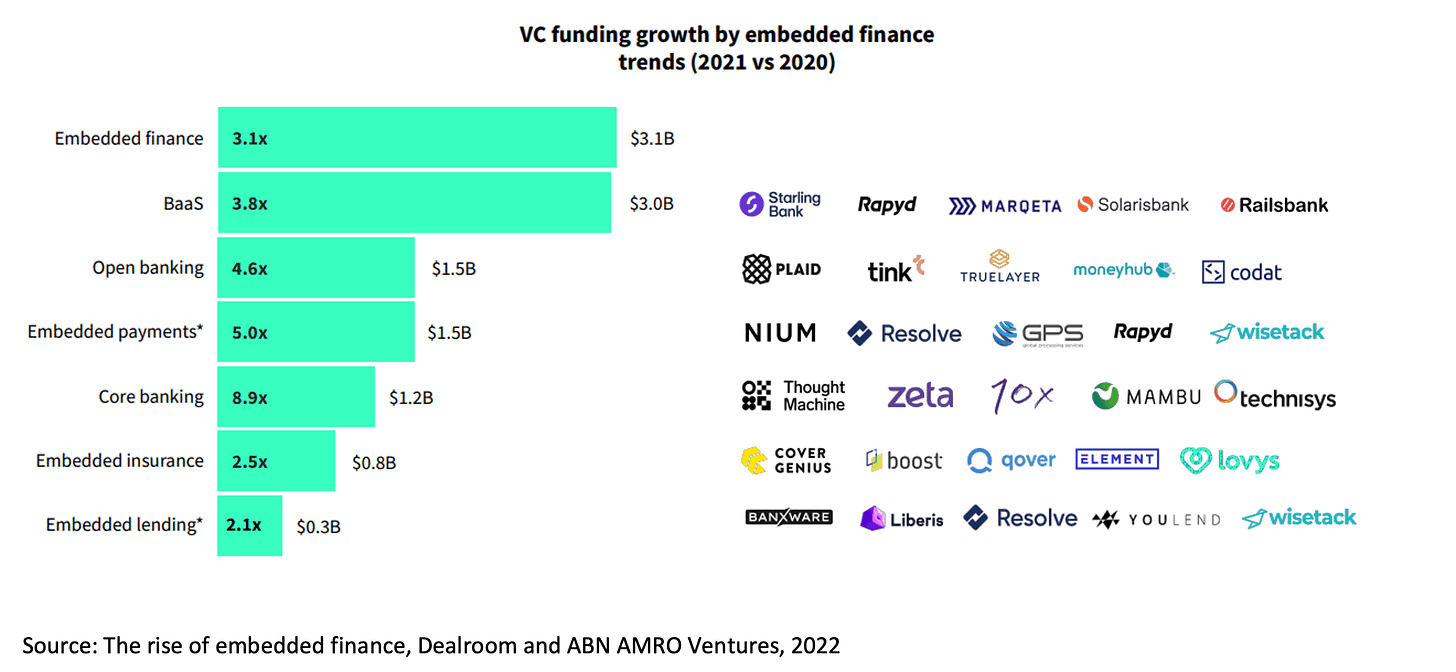

1’01”: Setting the scene in Fintech 2022 & what are the symptoms of things going wrong in the Banking-as-a-Service (BaaS) space

10’01”: The recipe for success in the BaaS space and the opportunities over the next coming years

13’19”: The dialetic between infrastructure and application and their phases of innovation

19’32”: Optimising the operating model for maximum efficiency & where/how regulatory influence plays a part

24’27”: The tangible impact of regulation & how this may help alleviate the current state of affairs

28’04”: The cost impact of fintech solutions on the value chain & what these costs may look like

31’31”: The optimal outcome for fintech infrastructure: embedded & bundled, or independent development, or acquisition of leading providers of services

34’00”: The optimal outcome for fintech applications: build a full service neobank or build a revenue generating component and grow from there

37’13”: Channels to use to connect with Will & Lex

Sneak Peek:

Lex Sokolin:

…you've got a lot of the horizontal players saying, "Look, build on our APIs," and a challenge on reaching the customer. So, one way it could go is the bundling of all of this stuff together again into a fat API first embedded finance like Super Bowl. But then is that the right outcome? Or maybe the right outcome is just, it was always hopeless to try and put scotch tape of APIs on traditional banking and it's all computational blockchains and DeFi, that's the only way to go. How do you think the industry dynamics will play out?

Will Beeson:

Yeah, so firstly, I think you nicely verbalized the way I think about this also, which is that there has to be a consolidation optimization on the efficiency side. I think one opportunity is for banks, sponsor banks that want to genuinely commit to this long-term. I think they can right now build a very strong competitive position by bundling, sounds dangerous, but finding ways to either independently develop or acquire the third or fourth leading provider of some of these services to wrap them into the sponsor bank or banking-as-a-service stack.

I think the other opportunity that the ultimate winners in the sponsor bank space have is to rather than think of themselves, the way that many SaaS companies generally do, which is like, "Here's our self-serve API, put in your credit card number, here's the documentation, do whatever you want," to think more strategically about how they can really…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions