Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Antonio Juliano, founder and CEO of dYdX - a crypto derivatives trading platform that caters to professional traders outside the U.S. It averages roughly $2 billion in daily trading volume (Coinbase does about $5 billion)

After obtaining a computer science degree at Princeton University in 2015, Antonio started working at Coinbase as a software engineer, where he learned about cryptocurrency and the world of blockchain. He was fascinated by the new technology, especially after listening to some of the most prominent people in the space give talks at Coinbase, such as Vitalik Buterin and Polychain Capital founder Olaf Carlson-Wee.

👑See related coverage👑

Digital Wealth: RIA custodian Altruist raises $112MM to battle Schwab and Fidelity

[PREMIUM ACCESS]: Long Take: Is Apple's Goldman-powered 4.15% yield account the fintech apocalypse?

Timestamp

1’22”: Antonio’s foundational experiences at Coinbase, and how the concept of trading coins on a centralized exchange was received at the time

8’57”: Breaking down the definitions, functions and directions of decentralized exchanges, automated market makers, their order books, and liquidity

14’49”: What a perpetual contract is, how it functions, what are the limits and rules behind it and how it has evolved over time

24’04”: The mechanics behind the current market structure behind selling on-chain positions, and the best practices that stemmed from bad incidents

29’47”: Layer 2s - what they are relative to dYdX, what dYdX has done with them, what the current initiatives are involving them at dYdX, and their future

39’29”: The Cosmos ecosystem relative to Ethereum, and the future of how the market structure will evolve

42’29”: The future of dYdX and how it will evolve over time

45’12”: The channels used to connect with Antonio & learn more about dYdX

Sneak Peek:

Antonio Juliano:

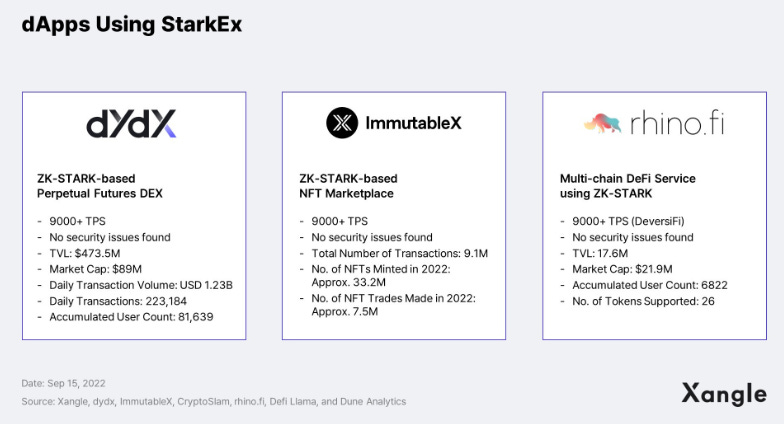

…Layer 2s are basically just more scalable blockchains that are built on top of another blockchain. And this is important because one of the biggest challenges in building in crypto is that things are really not scalable. So, I'll kind of walk through the specific story for dYdX and why we chose to build on a Layer 2, which is how dYdX works today. So, I think this was like 2020 or 2019 or so. There was a huge bull market in crypto. That was awesome. Finally, we're getting a ton more trading volume and stuff. But the problem was gas fees were through the roof on Ethereum. So, prior to this event happening, dYdX was just a smart contract on regular old Layer 1 Ethereum and you might have to pay a few cents to make a trade, which is okay because you're already probably paying more trading fees than that so who really cares if you're paying a few cents to make a given trade.But the problem was the rate at which gas fees spiked was pretty insane, to be honest. And it got to the point where people were having to pay literally on the order of a hundred dollars to make a single trade on dYdX just because the gas fees were so high on Ethereum. And this was clearly not sustainable. Who's going to use an exchange where you have to pay a hundred dollars to make a single trade? Nobody. So, we thought a lot about this and it effectively pushed us to be one of the really big early adopters of Layer 2. And the specific Layer 2 that we're built on is called Stark-based rollup, or if you've heard the term like zero-knowledge rollups, it's very similar to that.

We're in partnership with a company called Stark, where right now, which is one of the big leaders in this kind of technology. And we moved dYdX from…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions