A Year in Financial Models, Fintech Valuations, Super Apps, Big Tech, Decentralized Finance, CBDCs, Economic Poetry, the Multiverse, Pandemic, Revolution, Crypto Art, and the Nature of the Universe

Hi Fintech futurists --

You should be out partying! Or rather, you should be inside, partying. I guess reading the Blueprint is your version of inside-partying. And writing it is *our” version of inside-partying. Glad we got that established.

All that partying makes us think of what an absolutely schizophrenic, psychotic bummer the year 2020 turned out to be.

Welcome then, dear reader, to our 2020 retrospective. A new shape has been emerging in this corpus of writing, and here is the best stuff — according to you. And if you haven’t yet, this is the last time to take advantage of the holiday special offer below:

Financial Models and Valuations for Neobanks, Digital Wealth, and Coinbase

How Monzo, Revolut, and Starling get to break-even, and comparison with WeChat and Facebook. Lots of folks loved our financial tear down of the economics of the European neobanks. Part of their pleasure is critiquing how far off the neobanks are from profitability. Well, that was a surprise. Starling and Revolut both reached profitability towards end of this year after everything went digital. And Monzo raised a round. We did a podcast with Anne Boden of Starling on their number ($4B of deposits and 1.8MM customers), as well as one on Tinkoff (8 million customers, even more profitable).

How Coinbase Pre-IPO Economics Could Get a $15 Billion Valuation. We built up the model for Coinbase as well, pulling together public data to approximate the business pre-IPO with a valuation of over $15 billion. Well, Coinbase did file their S-1 and is planning to go public. Grab the model before … there’s a better model.

How Robinhood makes $90MM from order flow, and how DeFi is different. Haha! A cute little article about $90MM from order flow. We meant $1 billion from order flow. Check out our fantastic podcast with Paul Rowady of Alphacution — Understanding Robinhood, Derivatives, and Market Makers to see this clockwork machine in action.

Honorable mention: Is Plaid cheap at $5.3 billion for $500 billion Visa? The anti-trust authorities do seem to think so.

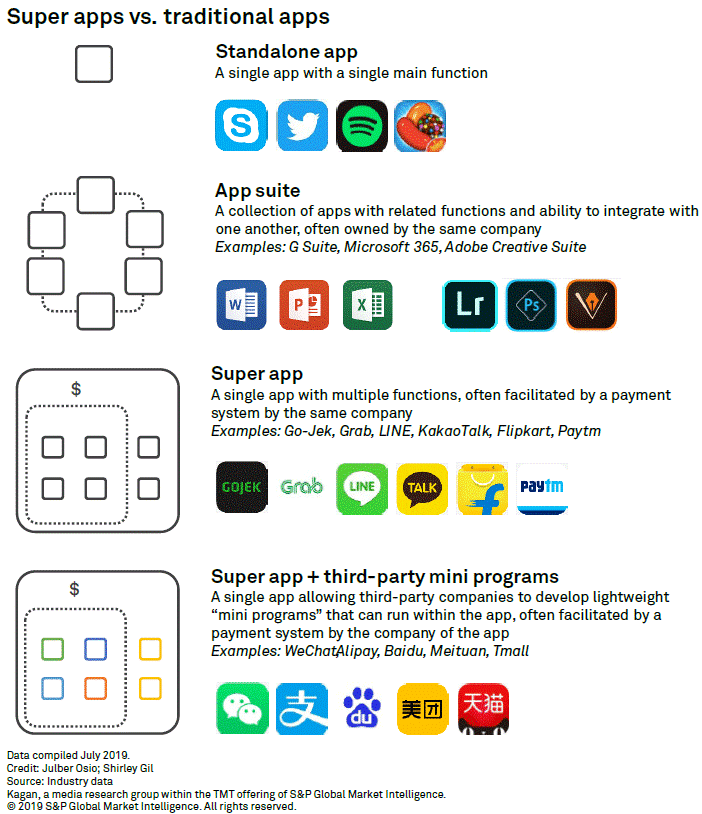

VC Bingo: Big Tech Fintech Embedded Finance Super Apps

Amazon/Goldman partnership, TikTok banking license, and Ethereum fintech through the lens of Aggregation Theory & Super Apps. This is one of our better write-ups connecting aggregation theory to payment rails to economies. While it is a recurring theme — because it is correct — this version of it still sings its song. It is also a clear signal of Goldman changing the nature of its firm to compete in technology audience footprints. This is the step-by-step guide you need to grok modern Goldman.

Google has come to Banking. What does that mean, and what should we do about it? The other Gruffalo of big tech — Google — is 20 million consumers deep in a neobanking app in the United States. We loved doing this detailed tear-down, and thinking through the generally terrifying outcome for the Fintech niche. The predecessor article is also pretty good, stating — The tech companies will become the storefront to absolutely everything. There is no Internet, there is only Google. There is no commerce, there is only Amazon.

Is Ant Financial the best Fintech in the world? Let's analyze the IPO! Great annotated podcast conversation with Max Friedrich of ARK Invest. And of course also — haha! No more Ant IPO. Here is the follow-up with the more sobering message: The system versus the individual -- a meditation on the American election, Alibaba's dethroning, and Fintech theater.

Runner up — Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot? Yea, we just did this one, but oh man, how many times you will hear Embedded Finance in the next year. Bookmark, come back to it.

Decentralized Finance, Blockchain, and CBDCs

Why Peer-to-Peer models fail against oligopoly, with Lending Club shutting down p2p platform, Seedrs/Crowdcube merging, and Morgan Stanley buying Eaton Vance for $7B. A long take that nobody in DeFi will read, but there is a deep grain of insight here about the failure of P2P lending and crowdfunding models. They all (i.e., the Lending Clubs) end up becoming banks and seeking the thing it looked like they would disrupt. Why is the DeFi P2P theme different, we ask — and try to answer with the word “community”. We are also sort of mean to Libertarians in the write-up, so that’s something.

Will the Blockchain Economy run on Bitcoin, Ethereum, or Central Bank Digital Currency? A pretty reasonable take on whether CBDCs are a payment rail, an app ecosystem, a modern money, or a financial infrastructure. Lots of ways it could go, and this tells you how. We talk carefully about Visa and PayPal, which are companies that are very forward thinking about the crypto space. If you want some earlier thinking on China and CBDC design options, see War over Money reaches new heights, as Libra opts into regulation, China launches national blockchain, and Financial Stability Board raises alarm.

Top 5 Decentralized Finance predictions for 2020 and beyond; plus 20 key Fintech developments. We are cheating to try and summarize this whole year — this is from December 2019. But we got much of it right, with DeFi going from $600MM to $15B in 12 months. The predictions were: (1) Global Fintech champions like Robinhood, SoFi, Revolut, and Square will enter and win the crypto race as soon as the business model is established, (2) Risk management and regulatory transparency is paramount in DeFi, as leverage and systemic correlation threatens the ecosystem, (3) The software of Decentralized Finance will be replicated by central banks and governments and launched nationally, (4) Real world assets will be assimilated into the DeFi Borg cube through staking incentives, and would be a big win for the space, (5) Don't bet against Bitcoin, and try to pull its value into DeFi machines. The main thing that hasn’t yet panned out is assimilation of real world assets, except for China, where there is plenty of assimilation.

Runner up — a nice, detailed set of thinking on Yearn, the most advanced tech that DeFi has to offer: Mergers and Acquisitions in open-source Decentralized Finance, and its $5 billion market capitalization. It’s got your yield farming and your Pickles and Creams.

Watching the Pillaging and Burning of Traditional Finance

Finance blood in the water ($900B wasted on digital transformation) is why neobank Chime is $15B, and why Uniswap could be next. There is a whole series of these missives, giving a precise analytical logic tree on how finance firms have wasted $1 trillion trying to catch the tech industry. In this one, PwC is the mean analyst. Key takeaway — understand the kids.

Wirecard's collapse hurts Fintech & Crypto start-ups, like Lehman and Enron burned the economy and HSBC to fire 35,000; E*TRADE sells to Morgan Stanley for $13B; Legg Mason's $800B of managed assets bought for $4.5B. See there’s way more of this stuff. Finance companies are always failing — big and small. The HSBC and Legg Mason entries in particular are chilling. DeFi protocols aren’t immune either, getting popped open through financial exploitation by crypto literate technologists.

Let’s lump a few “regulators fight back” entries here as a lead in to the next section. FCA bans and CFTC prosecutes crypto-derivatives, SEC wins Kik ICO case and Crypto regulatory wargames with FinCen, FCA, and the US House of Reps, impacting Paxos, Compound, BBVA, and Northern Trust. The sovereign sword is still sharp, foolhardy entrepreneur!

Economic Poetry and Rallying Cries for Revolution

What Ray Dalio's new research says about American Empire, the US dollar, Gold, and Bitcoin. We were losing our minds in a Covid lockdown and contemplating the end of US, as its empire crumbles into techno oblivion. There is some solid macro-economics here, including trying to make sense of Modern Monetary Theory and Market Monetarism. One way to make sense of them is to buy Bitcoin and watch the money printing press drive its price up.

Black Lives Matter -- structural inequity is the norm, not the exception. Do the work, read this.

We talked about Covid. These are hard to read now. Slowing GDP growth by 1.5% is like another 10 million people getting infected with coronovirus, and Why $2 trillion is barely enough for the coming unemployment spike, expected 20%+ GDP slow-down, and small business crunch, and Creativity and courage are the vaccine -- from molecular technology, to digital workspaces, to solving for global health data. Much of this is an exercise in grim arithmetic. That the stock market is still WAY up after such an absurdly awful experience continues to boggle the mind with its falsehood.

We talked about Art. The absurdity of how the Internet is both beautiful and awful, and the memetic infection of Finance and How signalling explains SoftBank's $4 billion call option trade, SushiSwap's vampire attack, and why we make Art. These are almost impossibly dense with philosophy and rhetoric. And yet they cut to a truth that is hard to observe without the requisite amount of caffeine. There is art, there is artifice. There is theater, there is misdirection. All of this around a fire in a cave. A Zoom cave.

Runner up for best click-bait title — What can Fintech learn from Elon Musk and SpaceX getting astronauts to space for 90% cheaper than NASA? We had fun researching rockets, cost of fuel, and shooting a Tesla into the Sun.

The Multiverse and Augmented Finance

Apple's augmented reality leak, and what Fintech should do for the coming Multiverse. There is beauty in how frontier technology is coming together to de-platform sovereign by creating virtual worlds. There is also a lot of nonsense futurists say about the multi-verse. You decide. What we like about this entry is (1) the Star Wars references connected to Epic, and of course Tencent, the payments company, and (2) Apple’s AR glasses leaking, again with Apple being a payments company. One day, we’ll be right about this AR/VR payments thing.

Virtual communities and digital worlds are the difference between Finance Incumbents, Fintech, and DeFi. The multiverse is interesting because of its communities. Fortnite is incredible as a commerce mall and a social network. This analysis is a fast-forward through Zwift, Tomorrowland, Roblox, Genshin Impact into crypto art and NFTs. See also: Connecting the $2T in Art owned by UHNW investors, with the rise of crypto art and Beeple's $3.5MM NFT digital art auction.

The AI cluster running on top of the Internet has data mined you, and has some deep fakes to sell you. Someone had to make an artificial intelligence that ingested the entire Internet to make Doctor Seuss poetry. Well, GPT-3 is there for your pleasure, as are a variety of other horrors mathematically illustrated here. On a related dystopian note: White Obama made by Artificial Intelligence.

Philosophy and The Nature of this World

The Grand Theory of the Universe. Stephen Wolfram’s physics project posits that the universe is a cellular automata with basic rules, combined as such to create amazing complexity. His simulations generate the properties of conventional physics within mathematical toy dimensions. Gravity. Relativity. Quantum mechanics. And it all functions like a blockchain.

The nature of Consciousness, artificial intelligence, and how we see Finance. A difficult piece of writing, with some major breakthroughs for understanding how our mind creates models of the world, and how we ourselves are model within a model. There is a powerful close:

It is possible to re-adjust the sensors. It is possible to choose different colors. It is possible to model ourselves differently. They are all just construction and evolution — not some deep truth. It is in your mind.

Thank you for your continued readership and patronage. Let the turn of the annual page be fresh mana for your creativity.